The major affairs of the company are handled by the manager and hence he is entitled to receive some compensation for his efforts. This is termed Managerial Remuneration. The manager has to bring out the maximum potential of the employees while ensuring that the interests of the shareholders and othRead more

The major affairs of the company are handled by the manager and hence he is entitled to receive some compensation for his efforts. This is termed Managerial Remuneration. The manager has to bring out the maximum potential of the employees while ensuring that the interests of the shareholders and other stakeholders are secured.

MAXIMUM REMUNERATION

As per section 197 of the Companies Act, the Company has certain limits on paying maximum remuneration, depending on whether he is working full-time or part-time. If the company has only one whole-time manager, he is entitled to a maximum remuneration of 5% of net profits. If there is more than one whole time manager, then the percentage increases to 10%.

For part-time directors, the remuneration allowed is 1% of net profits (if there is a whole-time director present) and if no whole-time manager is present, then remuneration for a part-time director is 3%.

Therefore, a company can only pay a maximum remuneration of 11% of net profits.

A public company is allowed to pay remuneration in excess of 11% by :

- Passing a special resolution approved by the shareholders

- Subject to compliance with Schedule V conditions

Remuneration can be paid to such managers who do not have any direct interest in the company and also possesses special knowledge and expertise along with a graduate-level qualification.

PENALTY

Any person who fails to comply with the provisions of managerial remuneration shall be punishable with a fine that can vary from Rs. 1 Lakh to a maximum of Rs. 5 Lakhs.

However, Sec 197 applies to only public companies and hence private companies are free to pay managerial remuneration with no upper limit.

See less

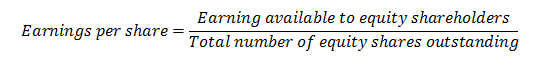

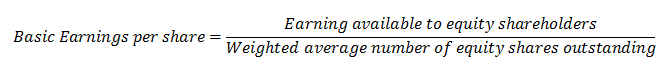

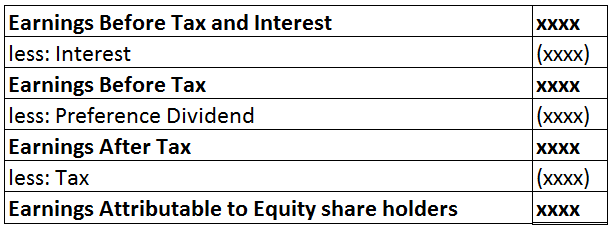

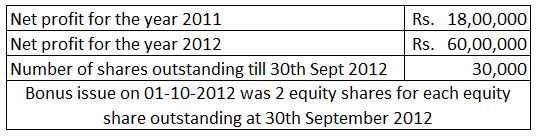

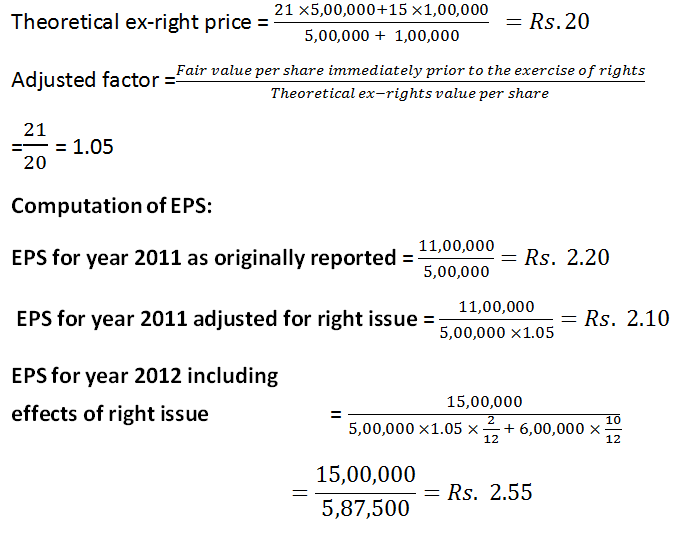

Earnings per share indicate the profit-generating capability of an enterprise and potential investors often compare the EPS of different companies to choose the best investment alternative.

Earnings per share indicate the profit-generating capability of an enterprise and potential investors often compare the EPS of different companies to choose the best investment alternative.

Interest on Investment is to be shown on the Credit side of a Trial Balance. Interest on investment refers to the income received on investment in securities. These securities can be shares, debentures etc. of another company. When one invests in securities, they are expected to receive a return onRead more

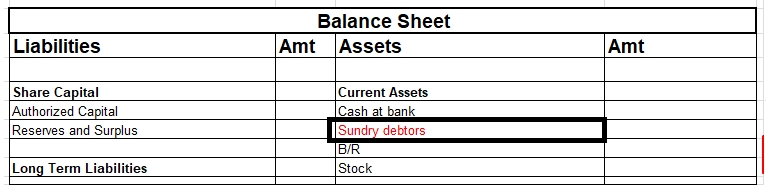

Interest on Investment is to be shown on the Credit side of a Trial Balance.

Interest on investment refers to the income received on investment in securities. These securities can be shares, debentures etc. of another company. When one invests in securities, they are expected to receive a return on investment (ROI).

Since interest on investment is an income, it is shown on the credit side of the Trial Balance. This is based on the accounting rule that all increase in incomes are credited and all increase in expenses are debited. A Trial Balance is a worksheet where the balances of all assets, expenses and drawings are shown on the debit side while the balances of all liabilities, incomes and capital are shown on the credit side.

For example, if Jack bought Corporate Bonds of Amazon, worth $50,000 with a 10% interest on investment, then the accounting treatment for interest on investment would be

Cash/Bank A/C Dr 5,000

To Interest on Investment in Corporate Bonds (Amazon) 5,000

As per the above entry, since interest on investment is credited, it will show a credit balance and hence be shown on the credit side of the Trial Balance. Interest on investment account is not to be confused with an Investment account. Investment is an asset whereas interest on investment is an income.

See less