The journal entry for the dividend collected by the bank is as follows: Bank A/c Dr. Amt To Dividend Received A/c Amt Here, Bank Account is debited and the Dividend Received Account is credited. This treatment is explained below. The logRead more

The journal entry for the dividend collected by the bank is as follows:

| Bank A/c Dr. | Amt | |

| To Dividend Received A/c | Amt |

Here, Bank Account is debited and the Dividend Received Account is credited. This treatment is explained below.

The logic behind the journal entry

This can be explained through the following rules of accounting:

- Golden rules of accounting

- Modern rules of accounting

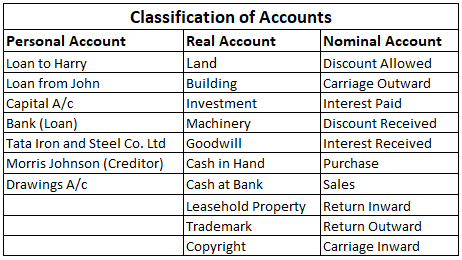

Golden rules of accounting

A bank account is a real account and the golden rule of accounting for the real account is, “Debit what comes in and credit what goes out”

Hence, the bank account is debited as the money is coming into the bank.

Dividend is an income hence dividend received is a nominal account. The golden rule of accounting for a nominal account is “Debit all expenses and losses and credit all income and gains”

Hence, the dividend received account is credited as income.

Modern rules of accounting

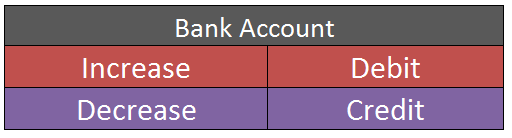

As per modern rules of accounting, a bank account is an asset account.

The asset account is debited when increased and credited when decreased.

Hence, the Bank account is debited here as it is increased.

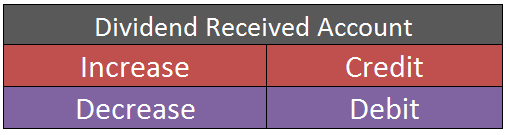

A dividend received account is an income account.

The income account is credited when increase and debited when decreased.

Hence, the dividend received account is credited here as it is increased.

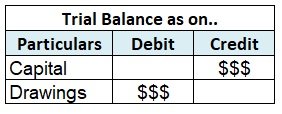

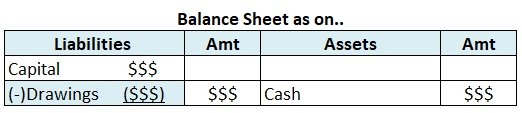

Treatment in the financial statements

Since the dividend received is an income; it is shown on the credit side of the Statement of profit and loss.

The bank account is an asset so it will be shown on the balance sheet.

See less

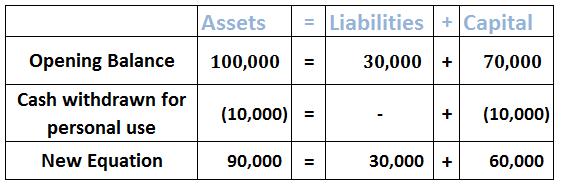

The entry for a loan (taken for any purpose) and a car loan are quite different. When you take a bank loan, you'll receive the money from the bank and subsequently, you'll start paying interest on it. In the case of a car loan, you don't receive the money from the bank. Once the car has been purchasRead more

The entry for a loan (taken for any purpose) and a car loan are quite different. When you take a bank loan, you’ll receive the money from the bank and subsequently, you’ll start paying interest on it.

In the case of a car loan, you don’t receive the money from the bank. Once the car has been purchased you’ll make the down payment and the remaining amount will be paid by the bank on your behalf. This car loan should then be paid to the bank in installments.

The following journal entry is posted to record the car loan taken for office use:

Car A/c is debited as there is an increase in the asset. Bank A/c is credited as the down payment for the car is made which reduces the assets. Car Loan A/c is credited as it increases liability.

The following entry is recorded for the repayment of the loan (first installment) to the bank.

Let me explain this with an example,

Kumar purchased a car for 25,00,000 for his office use. He made a down payment of 2,00,000 and took a car loan from HDFC Bank for 23,00,000. The following entry will be made to record this transaction.

See less