A. For a certain given period B. At a particular point of time C. After a fixed date D. None of the above

Capital Work in Progress refers to the total cost incurred on a fixed asset that is still undergoing construction as on the balance sheet date. These costs are not allowed to be used as an operating asset until the asset is ready to use. Until the construction of the asset is completed, the costs arRead more

Capital Work in Progress refers to the total cost incurred on a fixed asset that is still undergoing construction as on the balance sheet date. These costs are not allowed to be used as an operating asset until the asset is ready to use. Until the construction of the asset is completed, the costs are recorded as capital work in progress.

Depreciation is the systematic allocation of the cost of an asset over its useful life. Depreciation is charged on an asset from the date it is ready to use. Since Capital Work in Progress is not yet ready to use, depreciation cannot be charged on it.

Example

If a company owns a Machinery worth Rs. 45,000 out of which Rs. 15,000 is part of capital work in progress, then depreciation on such machinery would be calculated only on the part of machinery that is ready to use that is Rs. 30,000 (45,000-15,000).

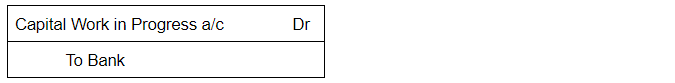

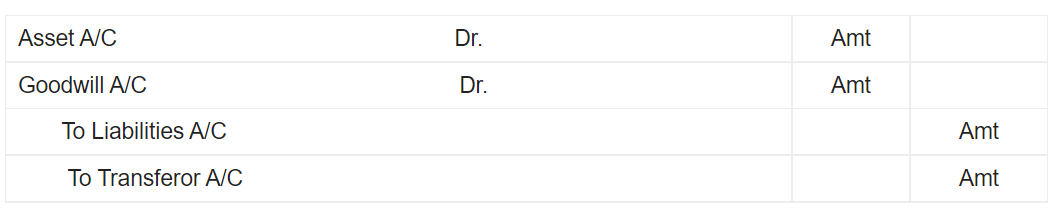

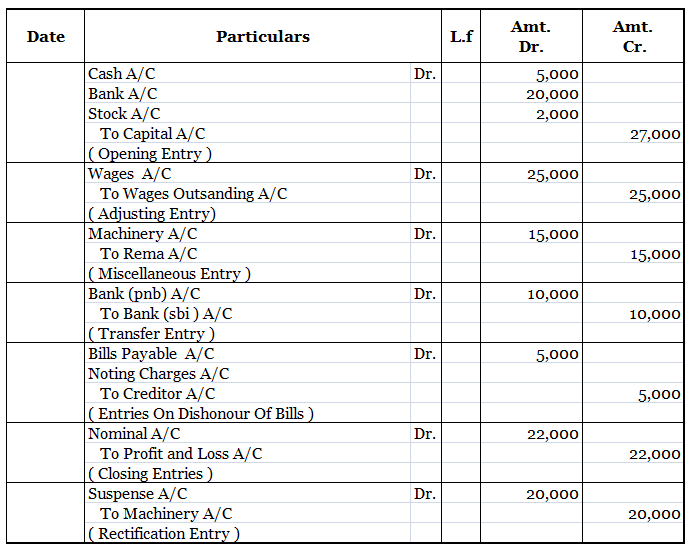

When an asset is undergoing construction, the journal entry for each expense would be recorded as

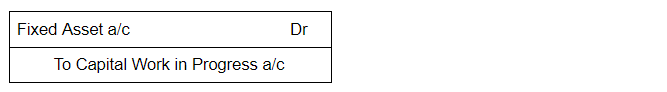

Further, when all construction of the above asset is completed, it is transferred to fixed asset account. This would be recorded as

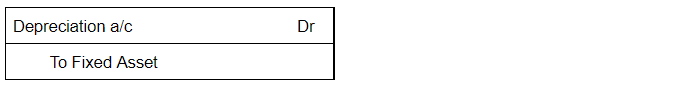

After transfer to Fixed Asset account, depreciation can be calculated and shown as below

If the construction of an asset is complete but has not been put to use till now, depreciation is still calculated as it is ready for use. It can be done through various methods like straight-line method, written down value method etc.

See less

The correct option is Option (b) at a particular point of time. A balance sheet discloses the financial position of an entity at a particular point of time. The particular point of time is generally the last date of an accounting year. Most of the business concerns follow an accounting year ending oRead more

The correct option is Option (b) at a particular point of time.

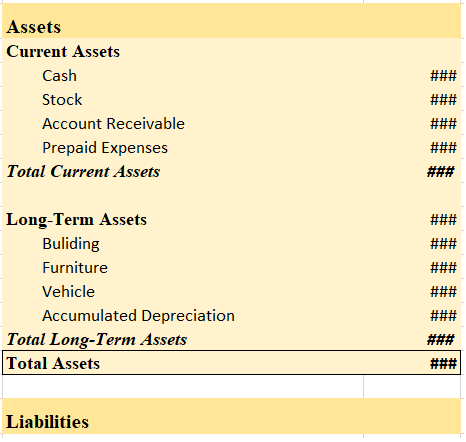

A balance sheet discloses the financial position of an entity at a particular point of time. The particular point of time is generally the last date of an accounting year. Most of the business concerns follow an accounting year ending on 31st March and prepare their balance sheet as at 31st March.

By financial position, it means the value of assets and liabilities of the entity. As an entity may enter into monetary transactions every day, the values of the assets and liabilities may also vary every day. Hence, to prepare the balance sheet of an entity, a particular point of time is to be chosen which is generally the last date of an accounting year

Option (a) for a given period of time is incorrect.

It is because the values of assets and liabilities of concern may differ daily, a balance sheet cannot be prepared to disclose the financial position of an entity for a given period of time.

The statement of profit or loss is prepared for a given period of time as it discloses the overall performance of an entity for a given period of time.

Option (c) after a fixed date is also incorrect.

The phrase, “after a fixed date” does not indicate a particular point of time. It may mean any day after a fixed date. For example, if there is an instruction to prepare a balance sheet that discloses the financial position of a concern after 30th March, it may mean 31st March, 1st April or any day thereafter.

As we know that a balance can be prepared for a particular point of time, this option seems wrong.

Option (d) None of these is incorrect too as Option (b) is the correct one.

See less