The Income Tax 1961 does not provide any rate of depreciation specifically for cameras. But we can consider camera within the block of ‘Computer including software’ for which the rate of depreciation is 40% at WDV method. It is a general practice for non-corporates to charge depreciation at rates slRead more

The Income Tax 1961 does not provide any rate of depreciation specifically for cameras. But we can consider camera within the block of ‘Computer including software’ for which the rate of depreciation is 40% at WDV method.

It is a general practice for non-corporates to charge depreciation at rates slightly lower than the rate provided by the Income Tax Act, 1961. But one cannot charge depreciation more than it.

In the case of corporate, the rates for charging depreciation are provided by the Companies Act 2013, which is

- 20.58% WDV and 7.31% SLM for cameras to be used for the production of cinematography and motion pictures.

- 25.89% WDV and 9.50% SLM for cameras which is part of electrical installations and equipment (CCTV cameras).

Let’s take an example:

Mr X is a jewellery shop owner and has installed CCTV cameras on 1st April 2021, costing ₹ 40,000 at various points in his shop to ensure safety and security. Keeping in mind the Income-tax rates, his accountant decided to charge depreciation @ 30% p.a. on the CCTV cameras.

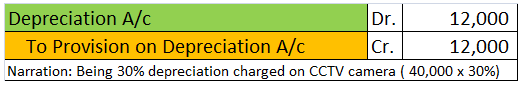

Following is the journal entry:

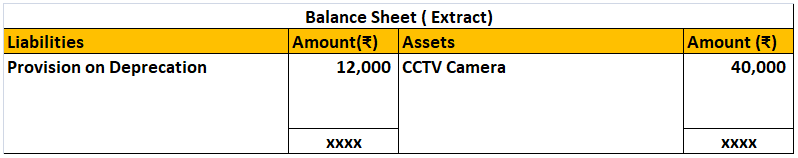

The balance sheet will look like this:

The entry for a loan (taken for any purpose) and a car loan are quite different. When you take a bank loan, you'll receive the money from the bank and subsequently, you'll start paying interest on it. In the case of a car loan, you don't receive the money from the bank. Once the car has been purchasRead more

The entry for a loan (taken for any purpose) and a car loan are quite different. When you take a bank loan, you’ll receive the money from the bank and subsequently, you’ll start paying interest on it.

In the case of a car loan, you don’t receive the money from the bank. Once the car has been purchased you’ll make the down payment and the remaining amount will be paid by the bank on your behalf. This car loan should then be paid to the bank in installments.

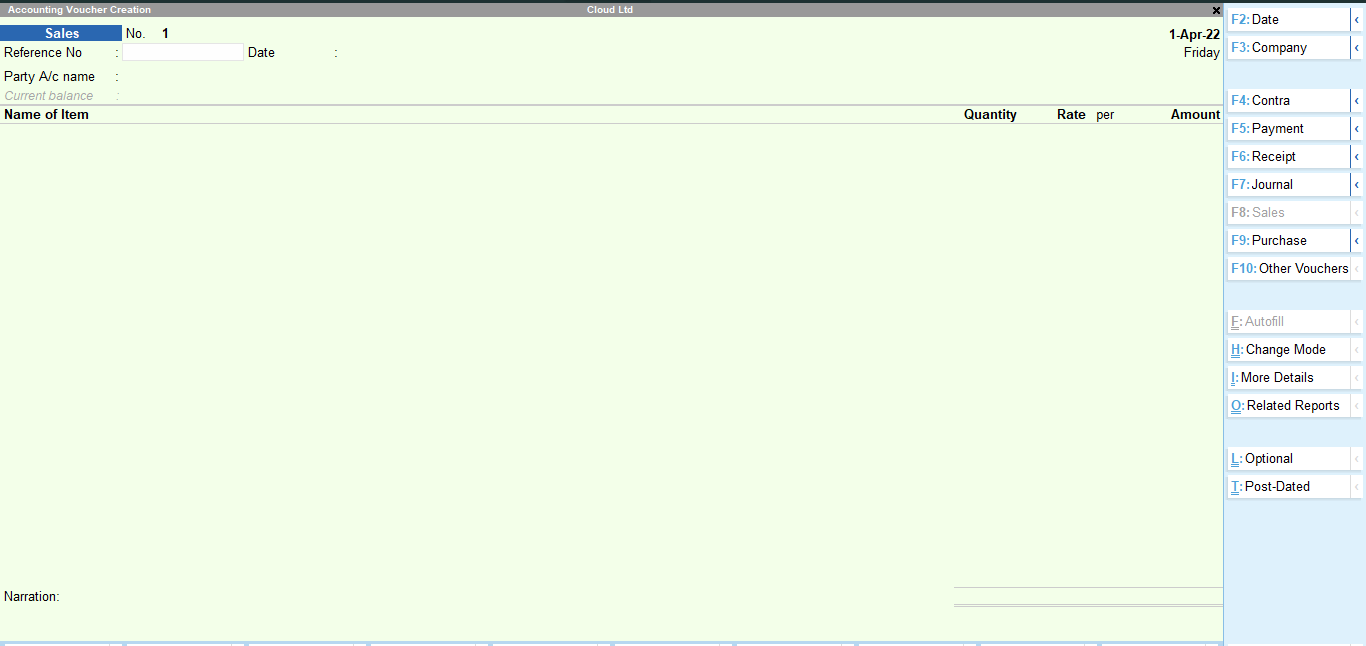

The following journal entry is posted to record the car loan taken for office use:

Car A/c is debited as there is an increase in the asset. Bank A/c is credited as the down payment for the car is made which reduces the assets. Car Loan A/c is credited as it increases liability.

The following entry is recorded for the repayment of the loan (first installment) to the bank.

Let me explain this with an example,

Kumar purchased a car for 25,00,000 for his office use. He made a down payment of 2,00,000 and took a car loan from HDFC Bank for 23,00,000. The following entry will be made to record this transaction.

See less