Whenever the proprietor/owner of a business withdraws cash or goods from the business for his/her personal use, we call it drawings. For example, Alex, proprietor of a soap manufacturing company, takes 50 pack of soaps costing 30 each for his personal use. So, 1,500 (50*30) will be considered as draRead more

Whenever the proprietor/owner of a business withdraws cash or goods from the business for his/her personal use, we call it drawings. For example, Alex, proprietor of a soap manufacturing company, takes 50 pack of soaps costing 30 each for his personal use. So, 1,500 (50*30) will be considered as drawings of Alex. One important thing to note here is whenever goods are withdrawn for personal use they are valued at cost.

Drawings are not an asset/liability/expense/income to the business. The drawings account is a contra-equity account. A contra-equity account is a capital account with a negative balance i.e. debit balance. It reduces the owner’s equity/capital.

Drawings being a contra-equity account has a debit balance, reducing the owner’s capital in the business. This is because withdrawals for personal use represent a reduction of the owner’s equity in the business.

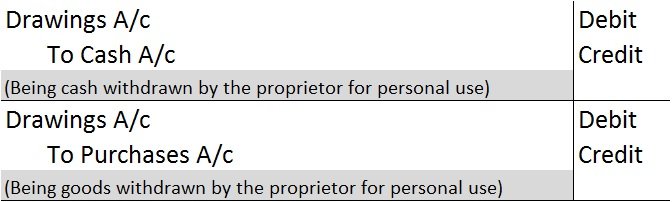

Drawings are not shown in the Income Statement as they are neither an expense nor an income for the business. However, the following journal entries are passed to record drawings for the year:

Drawings A/c is debited because it reduces the owner’s capital. Cash/Purchases A/c is debited as a withdrawal reduces the assets of the business.

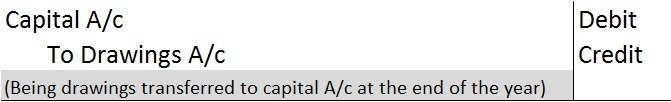

At the end of the year, drawings A/c are closed by transferring it to the owner’s capital A/c. We post the following entry to close the drawings A/c at the end of the year:

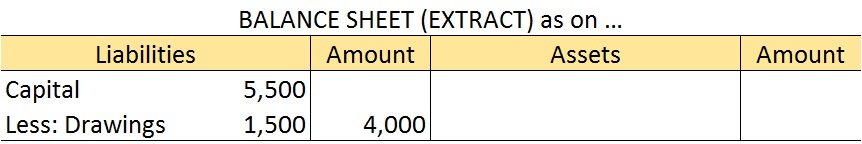

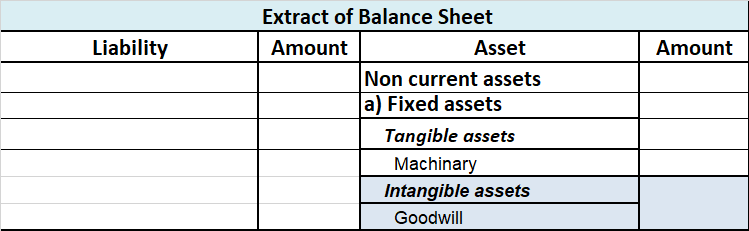

In the balance sheet, drawings are shown by deducting it from the owner’s capital A/c.

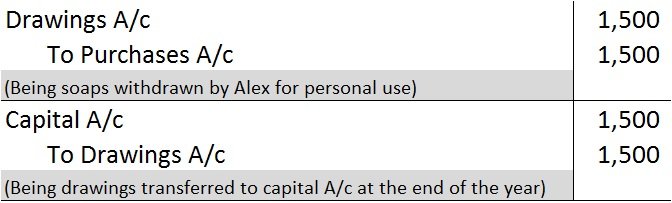

Let us take our earlier example of Alex. He withdrew soaps worth 1,500. At the end of the year, his capital was worth 5,500. The journal entry for recording the drawings is as follows:

In the balance sheet, drawings worth 1,500 are shown as follows:

Yes, Accounts Payable can have a Debit balance. Accounts payable is a liability and thus, has a credit balance but can have a debit balance in case the creditor is overpaid or when there is purchase return (for already-paid goods) ACCOUNTS PAYABLE Accounts payable refers to all short-term liaRead more

Yes, Accounts Payable can have a Debit balance. Accounts payable is a liability and thus, has a credit balance but can have a debit balance in case the creditor is overpaid or when there is purchase return (for already-paid goods)

ACCOUNTS PAYABLE

Accounts payable refers to all short-term liabilities of the business that are to be paid. These are usually paid within a duration of 90 days. It includes both Trade payable (goods and services purchased on credit) as well as expenses payable (used but payment not made yet) like rent payable, electricity bill, etc.

Businesses cannot make every payment on the spot. There can be cases when the business is facing a shortage of funds, can have funds but doesn’t have enough cash (or liquid funds) to make payment or simply doesn’t want to make payment on the spot to reduce its capital requirement.

So, like us businessmen also purchase goods on credit or use services for which payment is to be made soon. All these are liabilities for the business.

However, they must be related to the business to be considered as accounts payable.

DEBIT BALANCE OF ACCOUNTS PAYABLE

Debit balance of accounts payable means money owed by others. There is Debit balance when

OVERPAYMENT is made to the creditors or the supplier. It happens when the wrong amount is paid or payment is made twice for the same transaction.

Suppose you need to pay $10,000 as rent within 30 days. After 25 days you mistakenly made a payment of $12,000.

In this case,

PURCHASE RETURN of already paid goods also result in debit balance of Accounts Payable.

Suppose you bought goods worth $50,000 from Mr A on credit and paid for the same. Later, you returned all the goods because they were defective. Now, there will be Debit balance of Accounts Payable till there is a full refund of $50,000 by Mr A.

How is Accounts Payable Treated Normally?

Accounts Payable are the current liabilities of the firm and are shown under the head Current Liabilities in the Balance Sheet. Its liability, thus has a credit balance which represents the amount owed by the firm to others. It is credited when increases and debited when decreases.

For example – Suppose you purchased goods worth $30,000 and agreed to pay after 30 days. So, Accounts payable will be credited by $30,000 and purchases will be debited by $30,000.

Purchases A/c – $30,000 (debit)

To Accounts Payable A/c – $30,000

After 30 days payment is made in cash, which means the liability decreased. So, Accounts Payable A/c will be debited.

Accounts Payable A/c – $30,00

To Cash – $30,000

See less