General reserve is the part of profits or money kept aside to meet future uncertainties and obligations of the entity. General reserve is created out of revenue profits for unspecified purposes and therefore is also a part of free reserves. General reserve forms a part of the Profit & Loss ApprRead more

General reserve is the part of profits or money kept aside to meet future uncertainties and obligations of the entity. General reserve is created out of revenue profits for unspecified purposes and therefore is also a part of free reserves.

General reserve forms a part of the Profit & Loss Appropriation account and is created to strengthen the financial position of the entity and serves as a sources of internal financing. It is upon the discretion of the management as to how much of a reserve is to be created. No reserve is created when the entity incurs losses.

General reserve is shown in the Reserves & Surplus head on the liability side of the balance sheet of the entity and carries a credit balance.

Suppose, an entity, ABC Ltd engaged in the business of electronics earns a profit of 85000 in the current financial year and has an existing general reserve amounting to 100000. The management decides to keep aside 20% of its profits as general reserve.

Then the amount to be transferred to general reserve will be = 85000*20% = 17000.

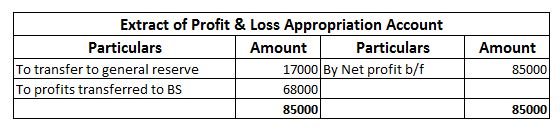

In the financial statements it will be shown as follows-

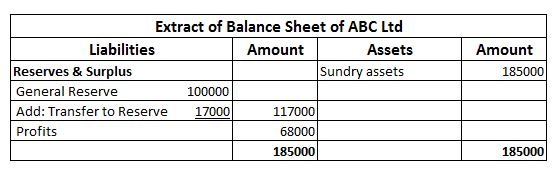

Now, in the next financial year, the entity incurs losses amounting to 45000. In this case, no amount shall be transferred to the general reserve of the entity and will be shown in the financial statement as follows-

The creation of general reserve can sometimes be deceiving since it does not show the clear picture of the entity and absorbs losses incurred.

See less

Brief Introduction The stock of finished goods left unsold at the end of the year is known as closing stock. As closing stock represent an asset i.e. the unsold finished goods, it has a debit balance. Closing stock appears on the credit side of the trading account and on the asset side of the balanRead more

Brief Introduction

The stock of finished goods left unsold at the end of the year is known as closing stock. As closing stock represent an asset i.e. the unsold finished goods, it has a debit balance.

Closing stock appears on the credit side of the trading account and on the asset side of the balance sheet. But, if closing stock is adjusted against purchase i.e. deducted from purchase account balance, then it doesn’t appear in the trading account.

It is always shown on the asset of the balance irrespective of its treatment as discussed above because it is an asset.

Though no ledger is maintained for closing stock in financial accounts of a business, the journal entry for the closing stock is passed and is as below:

Closing stock A/c Dr Amt

To Trading A/c Amt

(When the closing stock appears in trading a/c)

OR

Closing stock A/c Dr Amt

To Purchase A/c Amt

(When closing stock is adjusted against purchase A/c and not shown in trading a/c)

Generally, the closing stock is shown separately in the trial balance because it is already part of the purchase account balance.

Closing stock is ascertained at the end of the financial year and it has great importance as it directly affects the gross profit or loss of a business. Closing stock at end of a year becomes the opening stock of the next financial year.

Numerical Example

ABC trading reported the following particulars at the end of the financial year 20X2-20X3:

We will draw the trading and P/L account and balance sheet of ABC Trading using the above information.

As the closing stock is not given, we will calculate the closing stock as a balancing figure.

It can be also calculated using this formula:

Closing stock = Opening stock + Purchase + Gross Profit – Sales

See less