Under Activity-Based Costing, overheads are accurately assigned to different activities and their costs are determined through costing methods. Activities are those events that incur costs whereas overheads are expenditures that cannot be traced to any particular cost unit. A Cost driver refers to tRead more

Under Activity-Based Costing, overheads are accurately assigned to different activities and their costs are determined through costing methods. Activities are those events that incur costs whereas overheads are expenditures that cannot be traced to any particular cost unit.

A Cost driver refers to the factor that causes a change in the cost of an activity. Activity-Based Costing is done to establish a link between the activities and the product. The cost drivers are those links between the activities and the product.

Cost drivers are divided into four categories:

- Resource Cost Driver – It is a measure of the number of resources used by an activity. It assigns the cost of a resource to an activity.

- Activity Cost Driver – It is a measure of the frequency and intensity of demand, placed on activities by cost objects. It assigns activity costs to cost objects.

- Structural Cost Driver – It results from the economic and technological structure of the industry.

- Executional Cost Driver – It reflects the firm’s ability to plan and operate its production operations effectively.

A Cost Centre refers to a department in a business where costs can be allocated. These departments run various processes and incur costs. They can be related to the production of goods or the provision of services. Different centres are allocated different budgets and hence it enables the business to run efficiently by tracking its incomes and expenses easily.

Proper management of cost centres can help the company cut additional costs from each department. It also helps in more accurate forecasts depending on future changes.

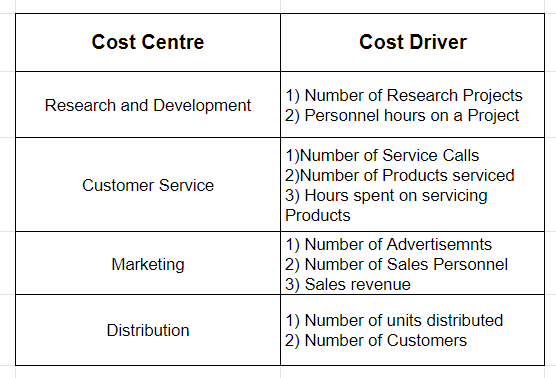

Cost centres and Cost Drivers are both important factors while following Activity-Based Costing. Some examples of cost drivers and cost centres are as follows :

See less

Let’s understand what a cashbook is: A petty cash book is a cash book maintained to record petty expenses. By petty expenses, we mean small or minute expenses for which the payment is made in coins or a few notes like tea or coffee expense, bus or taxi fare, stationery expense etc. Such expenses areRead more

Let’s understand what a cashbook is:

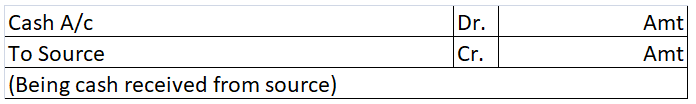

The manner in which entries are made

When cash is given to the petty cashier, entry is made on the debit side and in the petty cashbook and credit entry in the general cashbook.

Entries for all the expenses are made on the credit side.

Generally, the petty cashbook is prepared as per the Imprest system. As per the Imprest system, the petty expenses for a period (month or week) are estimated and a fixed amount is given to the petty cashier to spend for that period.

At the end of the period, the petty cashier sends the details to the chief cashier and he is reimbursed the amount spent. In this way, the debit balance of the petty cashbook always remains the same.

Format and items which appear in the petty cashbook

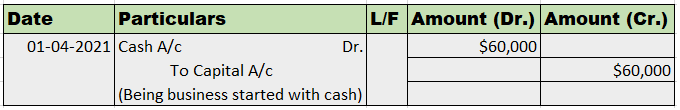

The format of the petty cashbook depends upon the type of petty cash book is prepared and the items appearing in it are nothing but petty expenses. Let’s see an example:-

A business incurred the following petty expenses for the month of April:-

Now we will prepare two types of cashbooks:

Here, the Petty cash book is of the same format as the general cash book.

The cash allocated for petty expenses is recorded on the debit side of the petty cash book and on the credit side of the general cash book.

Here, there are separate amount columns for each type of expense. As the name suggests, this type of petty cashbook helps to analyse the petty cash spending on basis of the type of expense.

See less