The Income Tax 1961 does not provide any rate of depreciation specifically for cameras. But we can consider camera within the block of ‘Computer including software’ for which the rate of depreciation is 40% at WDV method. It is a general practice for non-corporates to charge depreciation at rates slRead more

The Income Tax 1961 does not provide any rate of depreciation specifically for cameras. But we can consider camera within the block of ‘Computer including software’ for which the rate of depreciation is 40% at WDV method.

It is a general practice for non-corporates to charge depreciation at rates slightly lower than the rate provided by the Income Tax Act, 1961. But one cannot charge depreciation more than it.

In the case of corporate, the rates for charging depreciation are provided by the Companies Act 2013, which is

- 20.58% WDV and 7.31% SLM for cameras to be used for the production of cinematography and motion pictures.

- 25.89% WDV and 9.50% SLM for cameras which is part of electrical installations and equipment (CCTV cameras).

Let’s take an example:

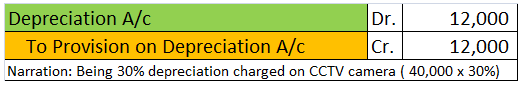

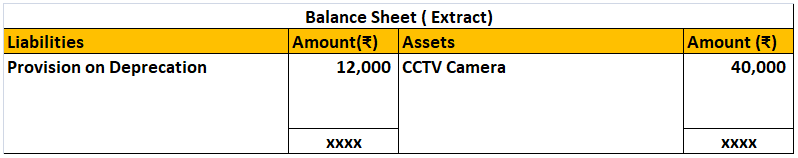

Mr X is a jewellery shop owner and has installed CCTV cameras on 1st April 2021, costing ₹ 40,000 at various points in his shop to ensure safety and security. Keeping in mind the Income-tax rates, his accountant decided to charge depreciation @ 30% p.a. on the CCTV cameras.

Following is the journal entry:

The balance sheet will look like this:

Preliminary expenses are those expenses that are incurred before the company’s business commences. These expenses are written off annually which does not involve any flow of cash. Therefore, in the cash flow statement, preliminary expenses are added back to net profit before tax and extraordinary itRead more

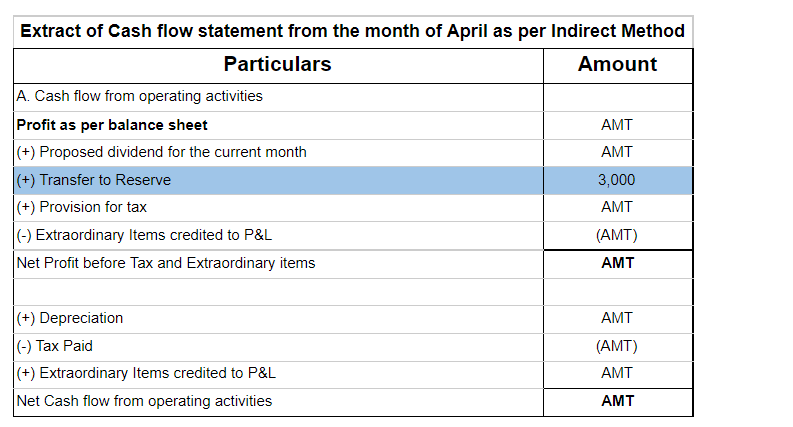

Preliminary expenses are those expenses that are incurred before the company’s business commences. These expenses are written off annually which does not involve any flow of cash. Therefore, in the cash flow statement, preliminary expenses are added back to net profit before tax and extraordinary items under the head operating activities (indirect method).

A cash flow statement is a financial statement that summarises the cash and cash equivalents entering and leaving the company. They can be classified into operating activities, investing activities and financing activities.

Reason for Treatment

Operating activities refer to those sources or usage of cash that relates to business activities.

As per the indirect method, the cash flow statement for operating activities begins with net profit before tax and extraordinary items. Since the company records non-cash expenditures also, they should add these back to net profit to find out the true cash flows. This is why preliminary expenses are added to net profit in the indirect method.

As per the direct method, all cash receipts are added and all cash expenses are subtracted to get cash flow from operating activities. Since preliminary expenses are a non-cash activity, they do not require any treatment in the direct method.

Preliminary expenses do not fall under the head investing activities as investing activities involve the acquisition or disposal of long term assets or investments. They do not fit in financing activities either as financing activities relate to change in capital or borrowings of the company.

Example

If the balance in preliminary expenses for the year 2019 was Rs.5,000 and its balance in 2020 reduced to 3,000, then its treatment in the cash flow statement would be:

See less