A balance sheet of a company is a financial statement that depicts the assets, liabilities and shareholders’ equity of the company at a point of time, usually at the end of the accounting year. A balance sheet of a company is reported in a vertical format which is different from that of a partnershiRead more

A balance sheet of a company is a financial statement that depicts the assets, liabilities and shareholders’ equity of the company at a point of time, usually at the end of the accounting year. A balance sheet of a company is reported in a vertical format which is different from that of a partnership where the horizontal format is used.

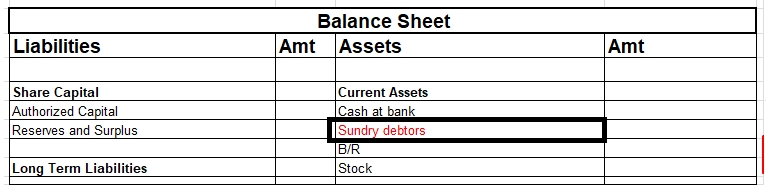

COMPONENTS OF A BALANCE SHEET

The three main components of a balance sheet are Assets, Liabilities and Shareholders’ equity.

- Assets: They are divided into two main categories that are current assets and non-current assets. If an asset is expected to be realised within 12 months or is primarily held for being traded, or is cash or cash equivalent, then those assets are termed as current assets. All assets that are not current assets are grouped under non-current assets. They are normally realised after 12 months.

- Liabilities: They are categorised as current liabilities and non-current liabilities. If the amount owed by the company to an outside party is due to be settled in 12 months, then it can be termed as a current liability. The rest of the liabilities are referred to as non-current liability.

- Shareholders’ Equity: This is the money owed to the owners of the company, that is shareholders. It is also called net assets since it is equal to the difference between total assets and total liabilities. Their main categories are Shareholders’ Capital and Reserves and Surplus.

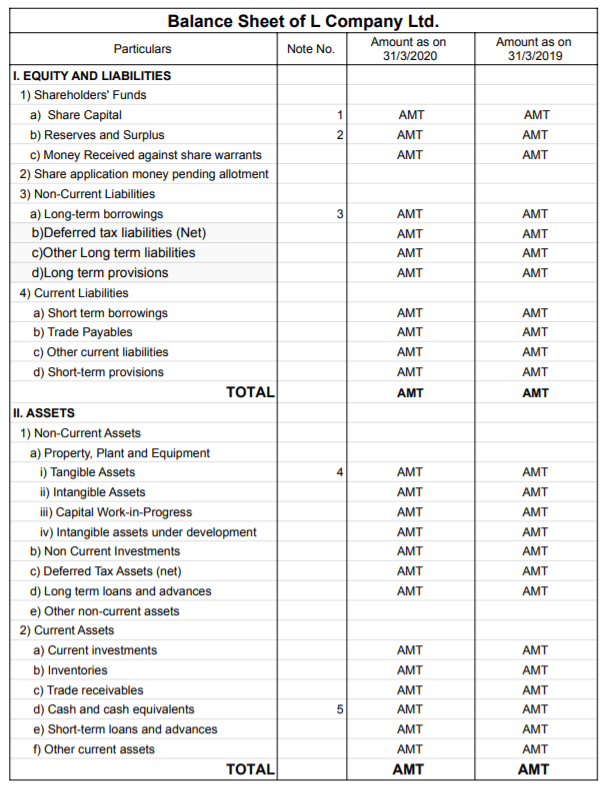

FORMAT OF BALANCE SHEET

As per the Companies Act 2013, the following format should be used for preparing a balance sheet.

From the above Balance sheet, we should get:

Assets = Liabilities + Shareholders’ Equity

Relevant notes for each component should also be prepared when necessary.

See less

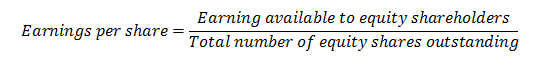

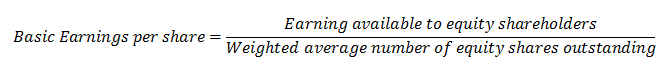

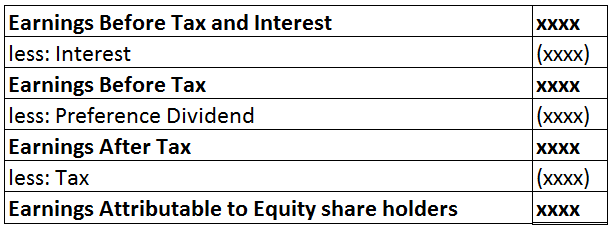

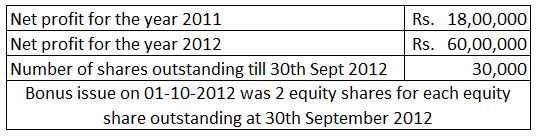

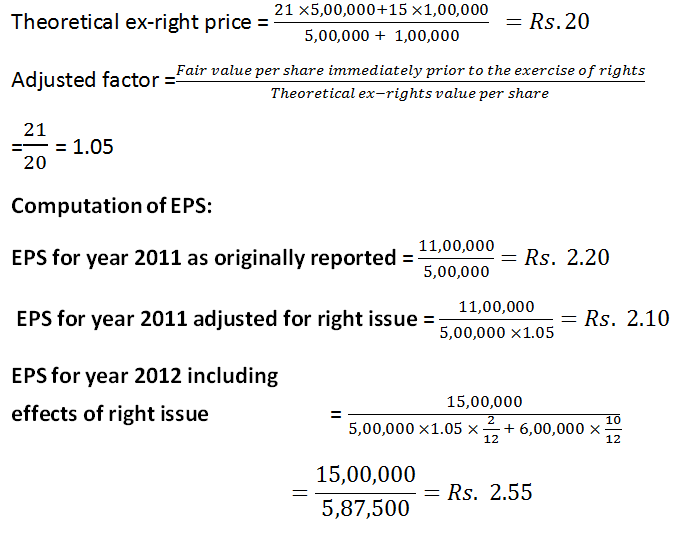

Earnings per share indicate the profit-generating capability of an enterprise and potential investors often compare the EPS of different companies to choose the best investment alternative.

Earnings per share indicate the profit-generating capability of an enterprise and potential investors often compare the EPS of different companies to choose the best investment alternative.

The major affairs of the company are handled by the manager and hence he is entitled to receive some compensation for his efforts. This is termed Managerial Remuneration. The manager has to bring out the maximum potential of the employees while ensuring that the interests of the shareholders and othRead more

The major affairs of the company are handled by the manager and hence he is entitled to receive some compensation for his efforts. This is termed Managerial Remuneration. The manager has to bring out the maximum potential of the employees while ensuring that the interests of the shareholders and other stakeholders are secured.

MAXIMUM REMUNERATION

As per section 197 of the Companies Act, the Company has certain limits on paying maximum remuneration, depending on whether he is working full-time or part-time. If the company has only one whole-time manager, he is entitled to a maximum remuneration of 5% of net profits. If there is more than one whole time manager, then the percentage increases to 10%.

For part-time directors, the remuneration allowed is 1% of net profits (if there is a whole-time director present) and if no whole-time manager is present, then remuneration for a part-time director is 3%.

Therefore, a company can only pay a maximum remuneration of 11% of net profits.

A public company is allowed to pay remuneration in excess of 11% by :

Remuneration can be paid to such managers who do not have any direct interest in the company and also possesses special knowledge and expertise along with a graduate-level qualification.

PENALTY

Any person who fails to comply with the provisions of managerial remuneration shall be punishable with a fine that can vary from Rs. 1 Lakh to a maximum of Rs. 5 Lakhs.

However, Sec 197 applies to only public companies and hence private companies are free to pay managerial remuneration with no upper limit.

See less