Capital Redemption Reserve is a statutory reserve, which means it is mandatory for a company to create such reserve when it decides to redeem its preference shares. Capital Redemption Reserve cannot be utilised for any purpose other than the issue of bonus shares. Now let’s understand the reason behRead more

Capital Redemption Reserve is a statutory reserve, which means it is mandatory for a company to create such reserve when it decides to redeem its preference shares. Capital Redemption Reserve cannot be utilised for any purpose other than the issue of bonus shares.

Now let’s understand the reason behind it.

We know preference shares are those shares that carry some preferential rights:

- Dividend at a fixed rate

- Right to get repaid before equity shareholders in event of winding up of the company

- Other rights as specified in the Articles of Associations.

Also, unlike equity shares, preference shares are redeemable i.e. repaid after a period of time (which cannot be more than 20 years).

Generally, the creditors of a company have the right to be repaid first. So, in event of redemption of preference shares, the preference shareholders are repaid before creditors and the total capital of the company will but the total debt of the company is unaffected.

The gap between the debt and equity of the company will further widen and this will also increase the debt-equity ratio of the company. It will be perceived to be a risky scenario by the creditors and lenders of the company because the

So to protect the creditor and lender, Section 55 of the Companies Act comes to rescue.

Section 55 of the Companies Act ensure that the creditors and lenders of a company do not find themselves in a riskier situation when the company decides to redeem its preference shares by making it mandatory for a company to either

- issue new shares to fund the redemption of preference shares

OR

- create a capital redemption reserve if it uses profits for redemption

OR

- a combination of both

This will fill up the void created by the redemption of preference shares and the debt-equity ratio will remain unaffected. Keeping an amount aside in Capital Redemption Reserve ensures that such amount will not be used for dividend distribution and capital will be restored because it can be only used to issue bonus shares.

In this way the debt-equity ratio remains the same, the interest of the creditors and lenders secured.

Bonus shares are fully paid shares that are issued to existing shareholders at no cost.

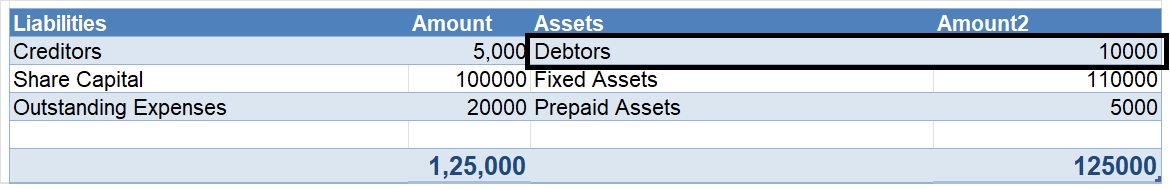

Let’s take a numerical example for further understanding:

ABC Ltd wants to redeem its 1,000 9% Preference shares at a face value of Rs 100 per share. It has decided to issue 8,000 equity shares @Rs 10 per share and use the profit and reserves to fund the deficit.

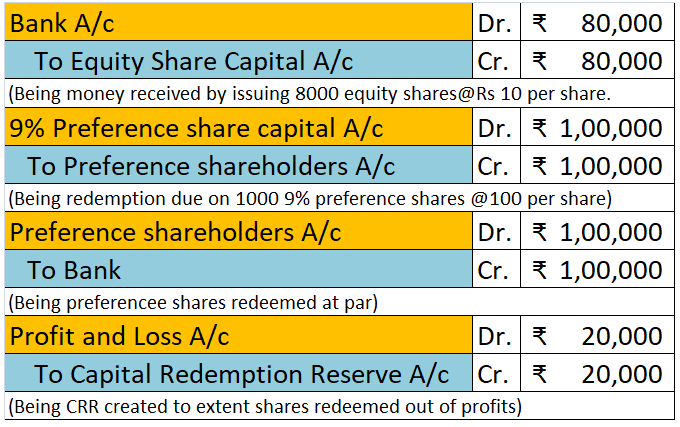

The journal entries will be as follows:

Working note: Rs

9% preference shares due for redemption (1,000 x 10) – 1,00,000

Less: Amount of new shares issued (8,000 x 10) – 80,000

Amount to be transferred to CRR 20,000

Hence, the reduction of total capital by Rs 1,00,000 due to the redemption of preference shares is reversed by issuing equity shares of Rs 80,000 and creating a Capital Redemption Reserve of Rs 20,000.

See less

Let us assume that we are discussing Input Tax Credit in GST of India. Input Tax Credit or ITC is the tax that a business pays on a purchase and that it can claim credit and use it to reduce its tax liability when it makes a sale. In other words, it means at the time of paying tax on output (Final sRead more

Let us assume that we are discussing Input Tax Credit in GST of India.

Input Tax Credit or ITC is the tax that a business pays on a purchase and that it can claim credit and use it to reduce its tax liability when it makes a sale. In other words, it means at the time of paying tax on output (Final sale product), you can reduce the tax you have already paid on inputs (Purchase).

Example For a manufacturer, tax payable on output (Final product) is Rs 500 and tax paid on input A is Rs 100, input B is Rs 50 and, input C is Rs50. You can claim INPUT CREDIT of Rs 200(100+50+50) and you only need to deposit Rs 300(500-200) in taxes.

Conditions- Only a Registered Person would be able to claim the benefit of Input Tax Credit of GST after satisfying the following:

Claiming of ITC – Discussed by taking an example, seller A sold his goods to B. Now B who is a buyer will be eligible to claim the input tax credit on purchases based on the invoices when he makes further sales. Now,

- S will upload the details of all the tax invoices in GSTR 1.

- All the details in accordance with the sales to B will reflect in GSTR 2A, and the same data will be taken by B to file GSTR 2 (i.e. details of inward supply).

- B will accept the details about the purchase that has been made and uploaded by the seller, the tax on purchases will be credited to ‘Electronic Credit Ledger’ of B and he can adjust it against future output tax liability and get the refund.

See less