Receipts and Payments A/C for the year ended 31st March 2020 Receipts Amt Payments Amt To Balance b/d (Cash) 180,000 By Salary 480,000 To Subscriptions 900,000 By Rent 50,000 To Sale of Investments 200,000 By Stationery 20,000 To Sale ...

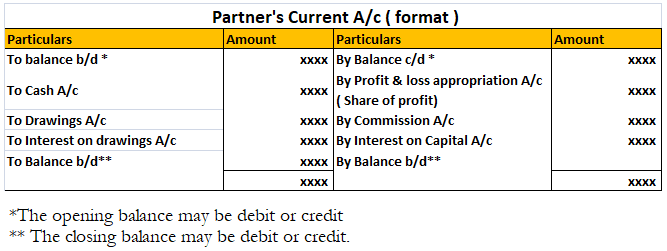

The correct option is C. Either Debit or Credit. Partner’s Current account is prepared when the capital account is of fixed nature. We know that partner’s capital account can be of fluctuating nature or fixed nature. In the case of fluctuating partner’s capital, all the transactions relating to theRead more

The correct option is C. Either Debit or Credit.

Partner’s Current account is prepared when the capital account is of fixed nature. We know that partner’s capital account can be of fluctuating nature or fixed nature.

In the case of fluctuating partner’s capital, all the transactions relating to the appropriation of profit, salary, commission, drawings, the introduction of capital, interest on capital etc. are passed through the partner’s capital account.

The balance of partner’s capital is generally credit but sometimes it may show debit balance indicating that the business owes to partner.

But when the partner’s capital account is of fixed nature, then separate partner’ current accounts are prepared. Through this account, all the transactions of revenue nature are passed like appropriation of profits, salary or commission paid to a partner, interest on capital and drawings. The balance of this account may be debit or credit.

The debit balance means the partner has withdrawn a lot of amount as drawings in anticipation of profits. The credit balance means the partner owes to the business.

The partner’s capital shows a fixed amount as capital and its balance is affected only when additional capital is introduced or capital is withdrawn. The balance of this account is always credit.

The partner current account is prepared when the firm wants to show the revenue transactions and capital transactions related to the partner ‘capital separately.

See less

Here I've prepared the Income & Expenditure A/c. Income & Expenditure A/c for the year ended 31st March 2021 Expenditure Amt Income Amt To Salary 4,80,000 By Subscriptions 9,00,000 To Rent 50,000 By Donations 10,000 To Stationery 20,000 To Loss on sale ofRead more

Here I’ve prepared the Income & Expenditure A/c.

Income & Expenditure A/c for the year ended 31st March 2021

Working Note: Calculation of Loss on sale of furniture

The following calculation is made to identify the loss incurred on the sale of furniture.

See less