The correct option is (d) None of these. AS-3(Revised) deals with the preparation and presentation of cash flow statements. A cash flow statement is a statement that summarises the movement of cash and cash equivalents of an enterprise in an accounting year. It helps the stakeholder to know: the amoRead more

The correct option is (d) None of these.

AS-3(Revised) deals with the preparation and presentation of cash flow statements. A cash flow statement is a statement that summarises the movement of cash and cash equivalents of an enterprise in an accounting year. It helps the stakeholder to know:

- the amount of cash generated by operating activities,

- amount of cash invested in various assets or sale of assets,

- the types of finance source utilised by an enterprise and

- the net cash flow of the business.

Provision for depreciation is actually a charge on profit, i.e. it will be deducted even if there is loss. Also, there is nothing mentioned in the AS-3(revised) from which we can consider the provision for tax as an appropriation of profit.

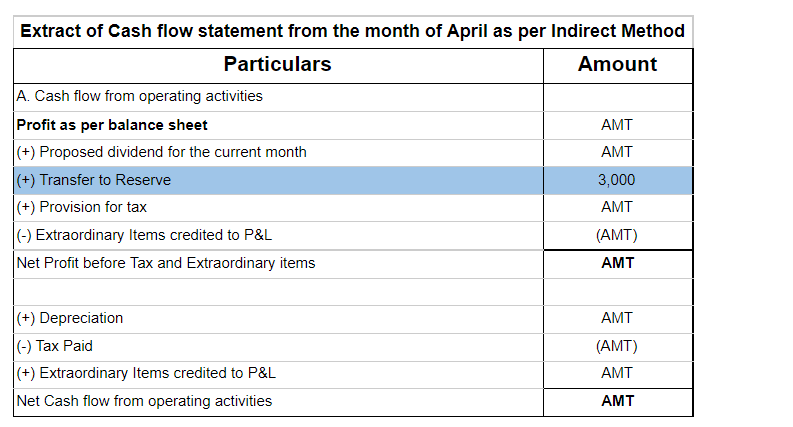

Generally, the cash flow statement is prepared as per the ‘indirect method’ by most enterprises.

As per the indirect method, the computation starts from Net Profit before tax and extraordinary items. To calculate this, we have to take the current year’s profit and add the current year’s provision for tax to it.

The reason behind it is that we need to obtain the cash flow from operations and the provision for tax is a non-cash item that has reduced the net profit. So, we have to add it back to the current year’s profit.

Option (A) Current Liabilities is wrong.

Though the provision for tax is classified as a current liabilities in the balance sheet, it is not considered as a current liability when making adjustments for changes in working capital while preparing cash flow statement.

Option (B) as appropriation of profit is wrong.

An appropriation of profit is an item for which an amount is put aside when there is profit. For example, transfer to reserves. But the provision for tax is a charge on profit.

Option (C) either (A) or (B) is also wrong because both the options are incorrect as discussed above.

See less

Order of Liquidity Under this method, a company organizes current and fixed assets in the balance sheet in the order of liquidity and the degree of ease by which it is converts converted into cash.On the asset side, we will write most liquid assets at first i.e. cash in hand, cash at bank and so onRead more

Order of Liquidity

Under this method, a company organizes current and fixed assets in the balance sheet in the order of liquidity and the degree of ease by which it is converts converted into cash.On the asset side, we will write most liquid assets at first i.e. cash in hand, cash at bank and so on and further. In the end, we will write goodwill.

Liabilities are presented based on the order of urgency of payment. On the liabilities side, we start from short-term liabilities for example outstanding expenses, creditors and bill payable, and so on. In the end, we write capital adjusted with net profit and drawings if any.

This approach is generally used by sole traders and partnerships firms. The following is the format of Balance sheet in order of liquidity:

Order of Permanence

Under this method, while preparing a balance sheet by a company assets are listed according to their permanency. Permanent assets are shown at first and then less permanent assets are shown afterward. On the assets side of the balance sheet starts with more fixed and permanent assets i.e. it begins with goodwill, building, machinery, furniture, then investments and ends with cash in hand as the last item.

The fixed or long-term liabilities are shown first under the order of permanence method, and the current liabilities are listed afterward. On the liabilities side, we start from capital, Reserve and surplus, Long term loans and end with outstanding expenses.

The following is the format of the Balance sheet in order of permanence:

Such order or arrangement of balance sheet items are refer as ‘Marshalling of Balance Sheet’.

See less