Sundry Debtors in Trial Balance The debtor is a company's asset, and assets are always debited in the trial balance. The trial balance is a statement maintained at the end of an accounting period, listing the ending balances in each general ledger account. There are two sides to this account, debit,Read more

Sundry Debtors in Trial Balance

The debtor is a company’s asset, and assets are always debited in the trial balance.

- The trial balance is a statement maintained at the end of an accounting period, listing the ending balances in each general ledger account.

- There are two sides to this account, debit, and credit and they include all the transactions done in the business over a particular accounting period.

As we know, assets, expenses, and drawings are always debited. That applies not only in journals but here as well, hence, all of your assets are to be debited.

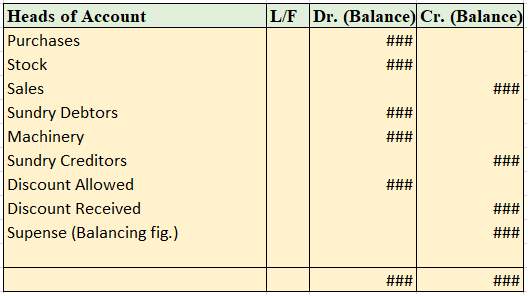

Trial Balance Statement

As we can see here, the sundry debtors (on the 4th) are debited like all the other assets, expenses, and losses. In the end, if the basic accounting equation i.e. assets=capital+liability is violated, a mismatch arises which in the balancing figure is shown under the name of suspense account. Such errors must not be found and corrected to avoid any mismatch in the balance sheet of the company.

Total Assets = Capital + Other Liabilities.

Therefore, this is how the sundry debtors are treated in the Trial Balance.

See less

Errors revealed by Trial Balance Trial balance, as we know, is a statement prepared after the ledger, followed by a journal. It has a list of all the general ledger accounts contained in the ledger of a business. Each nominal ledger account either holds a debit balance or credit. It is primarily useRead more

Errors revealed by Trial Balance

Trial balance, as we know, is a statement prepared after the ledger, followed by a journal. It has a list of all the general ledger accounts contained in the ledger of a business. Each nominal ledger account either holds a debit balance or credit.

It is primarily used to identify the balance of debits and credits entries from the transactions recorded in the general ledger in a certain accounting period. The debit and credit sides total are equal in a trial balance.

Classification of errors in the trial balance

Some of the common errors

Some more (commonly seen) errors while preparation of the trial balance:

Errors of Commission

Errors of Omission

Compensating Errors

Errors of Principles

See less