1) Cash Book 2) Statement 3) Journal 4) None of these

Definition Bad debts are a debt owed to an enterprise that is considered to be irrecoverable or we can say that it is owed to the business that is written off because it is irrecoverable. Sometimes debtors are unable to pay the amount due either partially or fully. the amount that is not receivableRead more

Definition

Bad debts are a debt owed to an enterprise that is considered to be irrecoverable or we can say that it is owed to the business that is written off because it is irrecoverable.

Sometimes debtors are unable to pay the amount due either partially or fully. the amount that is not receivable is a loss and is called bad debt.

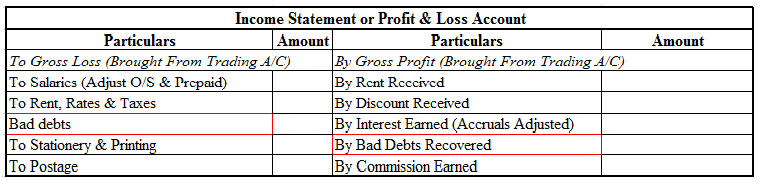

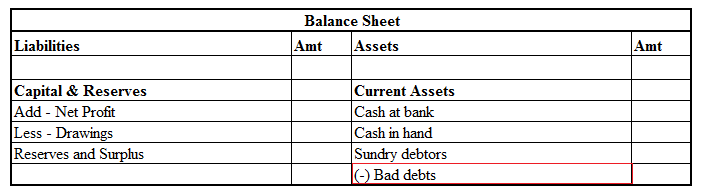

Bad debts are neither assets nor liabilities they are expenses that are debited to the profit and loss account and reduced from debtors in the balance sheet.

For example loans from banks are declared as bad debt, sales made on credit and amounts not received from customers, etc.

Related terms

So there are a few related terms whose meanings you should know

- Further bad debts :

- It means the amount of sundry debtors in the trial balance is before the deduction of bad debts. in this situation, entry for further bad debts is also passed into the books of account.

- That is bad debts are debited and the debtor’s account is credited. And the accounting treatment for them is the same as bad debts which I have shown you above.

- Bad debts recovered :

- It may happen that the amount written off as bad debts are recovered fully or partially.

- In that case, the amount is not credited to the debtor’s (personal) account but is credited to the bad debts recovered account because the amount recovered had been earlier written off as a loss.

- Thus amount recovered is a ‘gain’ and is credited to the profit and loss account.

Accounting methods

There are two methods for accounting for bad debts which are mentioned below:-

- First, is the direct written-off method which states that bad debts will be directly treated as expenses and expensed to the income statement, which is called the profit and loss account.

- Second, is the allowance method which means we create provisions for doubtful debts accounts and the debtor’s account remains as it is since the debtor’s account and provision for doubtful debts account are two separate accounts.

-

- Debts that are doubtful of recovery are provided estimating the debts that may not be recovered .amount debited to the profit and loss account reduces the current year’s profit and the amount of provision is carried forward to the next year.

-

- Next year, when debts actually become bad debts and are written off, the amount of bad debts is transferred ( debited ) to the provision for doubtful debts account.

-

- The amount of bad debts is not debited to the profit and loss account since it was already debited in earlier years.

-

- Provision for doubtful debts is shown in the debit side of the profit and loss account as well as shown as a deduction from sundry debtors in the assets side of the balance sheet.

Accounting treatment

Now let me try to explain to you the accounting treatment for bad debts which is as follows :

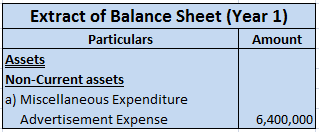

- Balance sheet

-

- In the balance sheet either it can be shown on the asset side under the head, current assets by reducing from that specific assets.

-

- For example, if credit sales are made to a customer who says it’s not recoverable or is partially recoverable then the amount is bad debt. It’s a loss for the business and credited to the personal account of debtors or we can say reduced from debtor those are current assets of the balance sheet.

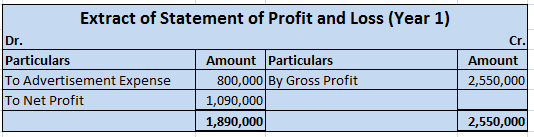

- Profit and loss account

-

- Bad debts are treated as expenses and debited to the profit and loss account.

- For example, as I have explained above, before transferring to the balance sheet, bad debt will be debited to the profit and loss account as an expense.

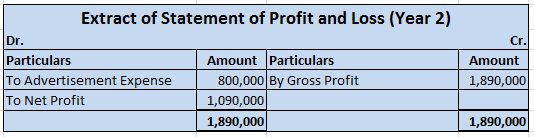

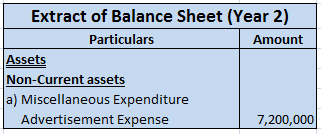

Now let me show you the extract of the profit and loss account and balance sheet showing bad debts and bad debts recovered which are as follows:-

1) A simple petty cash book is like a cash book. Definition The term 'petty' means small. A simple petty cash book is identical to a cash book, maintained to record the small expenses of a business like stationery, postage, stamps, carriage, etc. The cash received by a petty cashier is recordRead more

1) A simple petty cash book is like a cash book.

Definition

The term ‘petty’ means small. A simple petty cash book is identical to a cash book, maintained to record the small expenses of a business like stationery, postage, stamps, carriage, etc. The cash received by a petty cashier is recorded on the debit/ receipt side whereas, the cash he pays is recorded on the credit/ payment side. The difference between the sum of the debit and credit items represents the balance of the petty cash in hand.

Format

Explanation

Cash Book – A simple petty cash book is recorded and maintained just like the cash book. Just like a cash book records all the major transactions of the business, a petty cash book only focuses on the expenses which are of little value. Just like the cash book is maintained by the accountant of the business, the petty cash book is maintained by the petty cashier.

Therefore, a petty cash book is like a sub-part of a cash book itself.

Statement – A statement in accounting terms refer to a report. They are prepared to show some accounting data and different types of statements show different perspectives of the company’s financial health and performance. For e.g Balance sheet, trial balance, cash flow statements, etc.

Thus, a petty cash book is not a part of statements in accounting.

Journal – A petty cash book is not a part of a journal as a journal entry records business transactions in the accounting system for an organization and is also called the building block of the double-entry accounting method. While a petty cash book is maintained to record the small expenses of a business that are of little value.

Therefore, 1) Cash book is the correct option.

See less