Current Assets & Examples Current Assets are those assets that are bought by the company for a short duration and are expected to be converted into cash, consumed, or written off within one accounting year. They are also called short-term assets. These short-term assets are typically called currRead more

Current Assets & Examples

Current Assets are those assets that are bought by the company for a short duration and are expected to be converted into cash, consumed, or written off within one accounting year. They are also called short-term assets.

These short-term assets are typically called current assets by the accountants and have no long-term future in the business. Current assets may be held by a company for a duration of a complete accounting year, 12 months, or maybe less. A major reason for the conversion of current assets into cash within a very short amount of time is to pay off the current liabilities.

Examples

Some of the major examples of current assets are – cash in hand, cash at the bank, bills receivables, sundry debtors, prepaid expenses, stock or inventory, other liquid assets, etc.

- All of these assets are converted into cash within one accounting year.

- Liquid assets are a part of current assets. Although they are easier to be converted into cash than current assets.

- Current assets (along with current liabilities) help in the calculation of the current ratio. And they’re also referred to as circulating/floating assets.

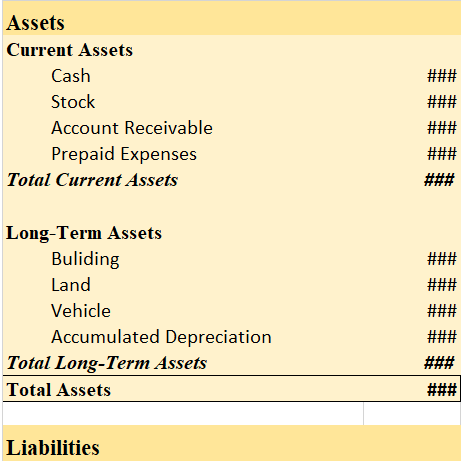

- Current assets are shown on the balance sheet (on the asset side) under the heading, current assets.

Current assets on the balance sheet

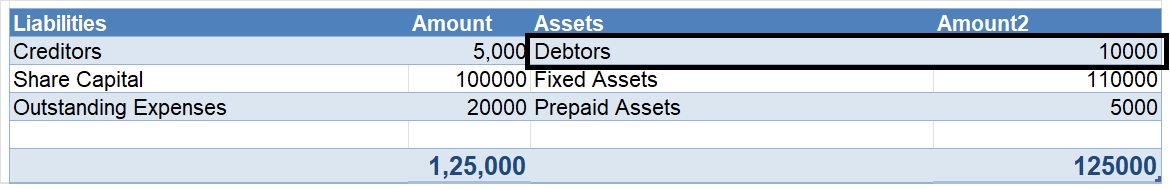

Balance Sheet (for the year…)

20 Journal Entries Journal is the book of initial entry, hence the transactions are at first recorded in the journal by the way of journal entries. Journal entries are made as per the double entry system of accounting, where for each transaction one account is debited and another account is creditedRead more

20 Journal Entries

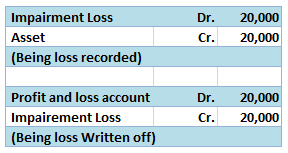

Journal is the book of initial entry, hence the transactions are at first recorded in the journal by the way of journal entries.

Journal entries are made as per the double entry system of accounting, where for each transaction one account is debited and another account is credited.

In the case of compound journal entries, one set of accounts is debited and one set of accounts is credited.

The amount of debit and credit always remains the same.

For example, when cash is introduced into a business, it affects two accounts: Cash A/c and Capital A/c. The accounts are debited and. credited as per the golden rules of accounting.

The journal entries which I have provided are based on the following transactions and events:

Journal Entries

The journal entries based on the above are as follows:

Ledgers

Ledger is known as the book of final entry. It is the book where the transactions related to a specific account are posted. This posting of transactions is done from journal entries.

The posting of journal entries into the ledger is performed in the following way:

The journal entry of cash sales is :

Here, Cash A/c is debited to Sales A/c. So, in the Cash A/c ledger, posting will be made on the debit side as “To Sales A/c”

In the Sales A/c ledger, the posting will be made on the credit as “By Cash A/c” because Sales A/c is credited to Cash A/c

For creating ledgers, journal entries are a prerequisite.

Now, the ledgers to be created as per the journal entries made above are as follows:

The account ledgers are as follows:

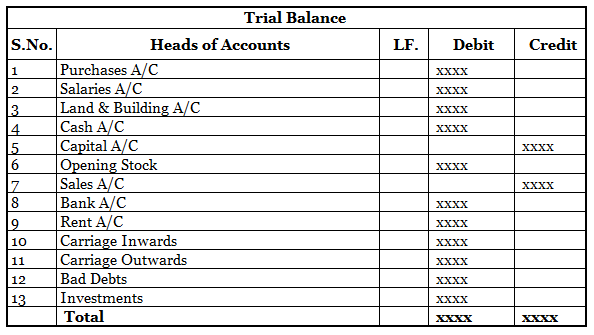

Trial Balance

A trial balance is a statement that is prepared to check the arithmetical accuracy of books of accounts.

In this statement, the total of all accounts having debit balance and the total of all accounts having credit balance is computed. If the total of debit and credit matches, then it can be said that the books of accounts are arithmetically accurate.

Here also we have prepared the trial balance by computing the total of accounts having debit balances and the total of accounts having credit balances

The debit column total and credit column total are matching. Hence, we can say that the books of accounts we have prepared are arithmetically accurate.

Note: Matt A/c and Uday A/c have not appeared in the trial balance because they do not have any carrying balance.

See less