To begin with, let me explain what is revaluation all about. So basically revaluation is a method of calculating the depreciation of assets where there are multiple identifiable assets of low value such as loose tools, live stocks, etc. Under this method assets like loose tools are revalued at the eRead more

To begin with, let me explain what is revaluation all about. So basically revaluation is a method of calculating the depreciation of assets where there are multiple identifiable assets of low value such as loose tools, live stocks, etc.

Under this method assets like loose tools are revalued at the end of the accounting period and the same is compared with the value at the beginning of the year. the difference amount is considered as depreciation.

The formula goes as :

REVALUATION= OPENING VALUE + PURCHASES – CLOSING VALUE

Let me take an example to show the same. Opening balance of Loose tools amounts to Rs.2,000 during the year, the business purchased loose tools of Rs.500 and at the year-end loose tool amounted to Rs.1,500 then revalued figure which will be shown as depreciation will be

REVALUATION= Rs.(2,000+ 500 – 1,500)

= Rs.1,000

The main discussion is”how to show adjustment of revaluation of the loose tool in financial statements”?

As we all know, loose tools are considered assets for the business, hence shown under the head current assets or fixed assets depending upon the nature of the business and the time for which it is held.

When the trial balance shows the debit value of loose tools, later on in the year-end the loose tools are revalued to a certain amount then the difference amount will be shown as depreciation in the Profit & Loss A/c and the revalued figure will be posted in the balance sheet asset side.

Let me support my explanation with an example,

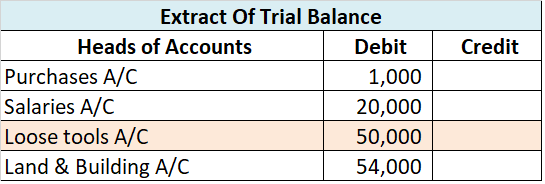

Given is the extracted trial balance of XYZ & Co.

we see the value of Loose tools in the given trial balance as Rs.50,000. At the year-end, these Loose tools were revalued at Rs.40,000.

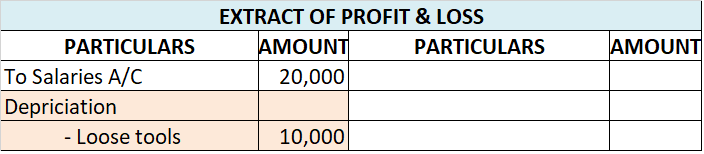

Therefore the adjustment in the financial statement would be like Rs (50,000 – 40,000) i.e Rs. 10,000 would be shown as depreciation under Profit & Loss A/c

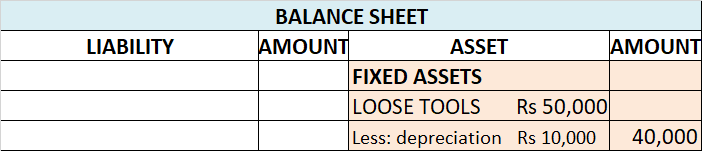

and the adjusted figure of Rs. 40,000 (i.e Rs.50,000 – Rs.10,000), will be shown on the asset side under the head fixed assets of the Balance Sheet.

When a business deposits its money into a bank account, it receives a percentage of the amount deposited as bank interest. The journal entry for interest received from a bank is as follows: Since the Bank account is a current asset, it gets debited. This is in accordance with the modern rules of accRead more

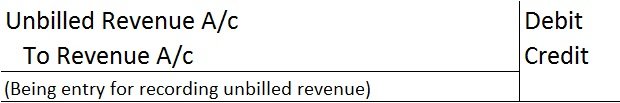

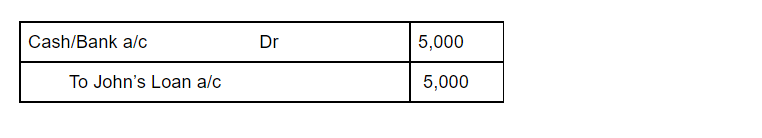

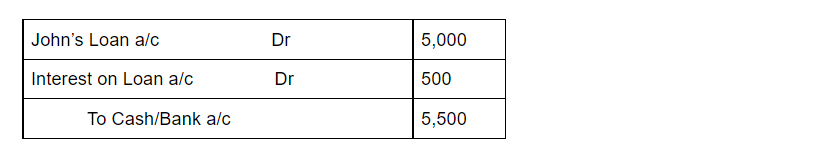

When a business deposits its money into a bank account, it receives a percentage of the amount deposited as bank interest. The journal entry for interest received from a bank is as follows:

Since the Bank account is a current asset, it gets debited. This is in accordance with the modern rules of accounting where an increase in assets is debited while a decrease in assets is credited. According to the traditional rules (golden rules) of accounting, a bank account is classified under Personal account with the rule of “debit the receiver” and “credit the giver”. In the given journal entry bank account is receiving money and is hence debited.

Meanwhile, Bank interest is the income received by the business and according to the modern rule of accounting, an increase in incomes is credited and a decrease in incomes is debited. Whereas, considering the traditional rules (golden rules), bank interest comes under Nominal account where “all incomes are credited” and “all expenses are debited”. Therefore, considering these rules, bank interest is credited.

EXAMPLE

If Gregor Ltd has a bank account with HSBC, having an opening balance of Rs 10,000 earning an interest of 5% per annum, then the journal entry for interest received from the bank is recorded as

The interest amount is taken on the amount deposited in the bank (10,000 * 5%).

See less