Similarly, someone asked Are loose tools current assets

Similarly, someone asked Are loose tools current assets

See lessPlease briefly explain why you feel this question should be reported.

Please briefly explain why you feel this answer should be reported.

Please briefly explain why you feel this user should be reported.

Similarly, someone asked Are loose tools current assets

Similarly, someone asked Are loose tools current assets

See lessThere are two types of ledger accounts in the accounting system – temporary and permanent. Temporary accounts are those whose balances zero out and we do not carry forward balances to the next year. Examples are revenue and expenses accounts or nominal accounts. The balances of such accounts are traRead more

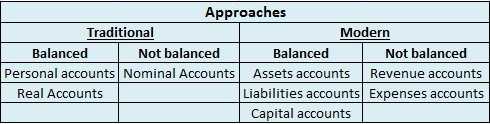

There are two types of ledger accounts in the accounting system – temporary and permanent.

Temporary accounts are those whose balances zero out and we do not carry forward balances to the next year. Examples are revenue and expenses accounts or nominal accounts. The balances of such accounts are transferred to the profit and loss account and therefore are not balanced.

Permanent accounts are those whose balances are carried forward to the next accounting year in form of opening balances. These accounts are balanced and such balances are transferred to the balance sheet. Examples are assets, liability and capital accounts or personal and real accounts.

Balancing an account means equaling both the debit and the credit side of the account. Generally, there is a difference between the accounts recorded as a carry down balance in the case of permanent accounts and as a transfer balance in the case of temporary accounts.

Balancing serves as a check to the double-entry rule of accounting.

Balanced accounts

As discussed above, the balanced accounts are shown in the balance sheet and the balancing figure for such accounts are carried forward to the next accounting period.

Unbalanced accounts

As per the above discussion, the balancing figures of unbalanced accounts are transferred to the profit and loss account and no balances are carried forward to the next accounting period.

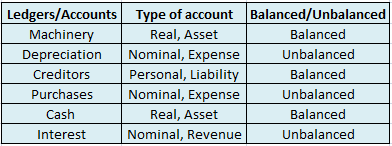

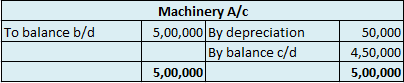

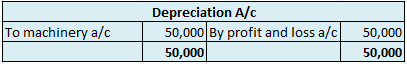

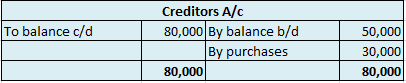

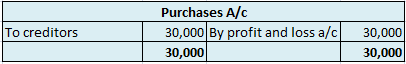

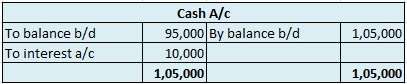

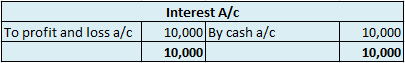

Suppose a company Shine Ltd. has machinery costing 5,00,000 at the beginning of the accounting period and charges depreciation of 10% on the asset. The company also has creditors amounting to 50,000 at the beginning of the period and purchases goods amounting to 30,000 on credit. It has a cash balance of 95,000 at the beginning of the period and earns interest amounting to 10,000.

Following ledgers would be prepared to record the above entries:

The above ledgers can be shown as follows:

The balance of the machinery account will be shown in the balance sheet and therefore it is a balanced account.

The balance is transferred to the profit and loss account and therefore depreciation account is an unbalanced account.

The balance of creditors account will be shown in the balance sheet and therefore it is a balanced account.

The balance is transferred to the profit and loss account and therefore purchases account is an unbalanced account.

The balance of the cash account will be shown in the balance sheet and therefore it is a balanced account.

The balance is transferred to the profit and loss account and therefore interest account is an unbalanced account.

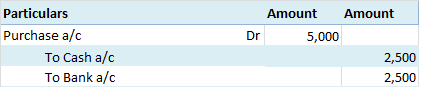

See lessWhen in a single transaction two or more accounts are involved, such kinds of transactions are termed as Compound entries. Example 1, Johnson Co. purchased goods worth 5,000, and half of the amount was paid in cash and the other half by cheque. So here three accounts are involved: Purchase account-Read more

When in a single transaction two or more accounts are involved, such kinds of transactions are termed as Compound entries.

Example 1, Johnson Co. purchased goods worth 5,000, and half of the amount was paid in cash and the other half by cheque.

So here three accounts are involved:

Purchase account- That is to be debited.

Cash account- That is to be credited.

Bank account- That is to be credited.

Journal entry:

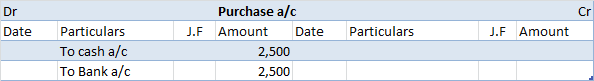

Now posting the above journal entry in a ledger account.

In the Journal, the Purchase account has been debited. So in the ledger, the purchase account will also be debited. Since the purchase account is debited in the ledger, the corresponding two credit accounts of this entry i.e. the cash and the bank will be written on the debit side in the particulars column. So while posting, the amount to be considered would be the amount individually paid in cash and bank as shown in the journal entry.

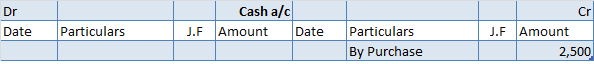

Cash a/c is credited with the purchase account. In the ledger, purchase a/c will be posted on the credit side. So while posting, the amount to be considered would be the amount individually paid in cash.

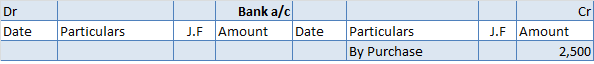

Bank a/c is credited with the purchase account. In the ledger, purchase a/c will be posted on the credit side. So while posting, the amount to be considered would be the amount individually paid in Bank a/c.

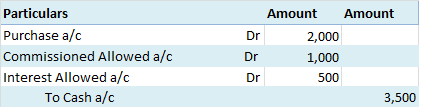

Example 2, Johnson Co purchased goods and made payment in cash 2,000. Along with it, it also paid commission and interest of 1,000 and 500 respectively.

So here four accounts are involved:

Purchase account- That is to be debited.

The commission allowed account- That is to be debited.

Interest allowed account- That is to be debited.

Cash account- That is to be credited.

Journal Entry:

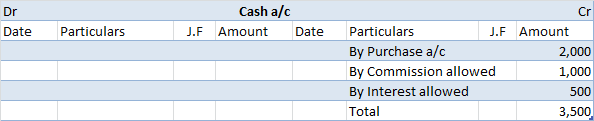

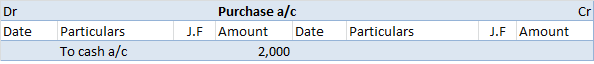

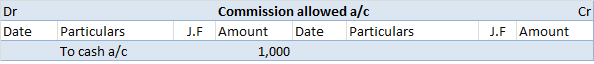

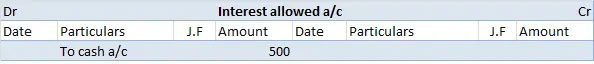

Now posting the above journal entry in a ledger account.

In the journal entry, the cash account has been credited. So in the ledger, the cash account will also be credited. Since the cash account is credited in the ledger, the corresponding three accounts will also be credited in the particulars column. As in the journal entry the three debit accounts viz. Purchase, the commission allowed, and interest allowed, the amounts written against them shall be entered in the respective accounts in the amount column on the credit side of the cash account.

Purchase a/c is debited with a cash account. In the ledger, Cash a/c will be posted on the debit side. So while posting, the amount to be considered would be the amount individually paid in the Purchase account.

The commission allowed a/c is debited with a cash account. In the ledger, cash a/c will be posted on the debit side. So while posting, the amount to be considered would be the amount individually paid in Commission allowed a/c.

Interest allowed a/c is debited with a cash account. In the ledger, cash a/c will be posted on the debit side. So while posting, the amount to be considered would be the amount individually paid in Interest allowed a/c.

See lessLet us first understand the concepts of Amortization and Impairment. Amortization refers to the expense recorded on the decline of the value of intangible assets of a company. Intangible assets include goodwill, patents, copyrights, etc. It reflects the reduction in the value of Intangible assets ovRead more

Let us first understand the concepts of Amortization and Impairment.

Amortization refers to the expense recorded on the decline of the value of intangible assets of a company. Intangible assets include goodwill, patents, copyrights, etc. It reflects the reduction in the value of Intangible assets over its life span.

Amortization is similar to Depreciation, however, while depreciation is over tangible assets amortization is over Intangible assets of the company.

For example, Cipla Ltd. acquired a patent over a new drug for a period of 10 years. The cost of creating the new drug was 80,000 and the company must record its patent at 80,000. However, the company must amortize this cost by dividing the cost over the patent’s life, i.e., the amortization cost would be 8,000 (80,000/10) p.a. for the next 10 years.

Impairment means a decline in the value of fixed assets due to unforeseen circumstances. Assets are impaired when the carrying value of assets increases its market value or “realizable value” and such increase is recorded as an impairment loss.

Now suppose, Cipla Ltd. had existing machinery which suffered physical damage and is recorded at 50,000 in the books but the realizable value of the asset would only be 20,000. Hence, the asset would be written down to 20,000 and an impairment loss of 30,000 will be recorded.

Differences between the two can be shown as follows:

| Amortization | Impairment |

| Amortization is a reduction in the value of Intangible Assets over their useful life. | Impairment is a reduction in the value of assets due to unforeseen circumstances. |

| Amortization is a continuous process and the value of an asset reduces over time. | Value of asset reduces drastically, creating a need to write down the value to its fair market value. |

| Amortization is charged annually. | Impairment is not an annual charge. |

| Amortization is shown as an amortization expense. | Impairment is shown as an impairment loss. |

| Reasons for amortization includes consumption, obsolescence, etc. | Reasons for impairment include damage to the asset, change in preferences, etc. |

| Amortization is charged on Intangible assets | Impairment is charged on fixed assets whether tangible or intangible. |

Suppose Unilever Ltd. has a patent over one of its products for a period of 5 years. The cost of the patent was 1,00,000. Then after 2 years one of its rivals, say ITC Ltd., launches a new product which is more preferred by the consumers over the one produced by Unilever Ltd. and the fair market value of the patent of Unilever Ltd. changes to 10,000.

Now in this scenario, Unilever Ltd. would have amortized the patent (costing 1,00,000) at 20,000 (1,00,000/5) p.a. for 2 years and the book value at the end of the 2nd year is 60,000 (1,00,000 – 40,000). Now due to the new launch by ITC Ltd. the drastic change in the value of the asset from the book value of 60,000 to the realizable value of 10,000 will be recorded as an Impairment loss. Hence Impairment loss would be recorded at 50,000 (60,000 – 10,000).

See lessInventory Turnover Ratio is the financial ratio that shows how efficiently a business sells and replenishes its inventory. It shows how well a business manages its inventory. Inventory Turnover ratio is calculated as follows: Inventory Turnover Ratio = Cost of goods sold / Average Inventory But whyRead more

Inventory Turnover Ratio is the financial ratio that shows how efficiently a business sells and replenishes its inventory. It shows how well a business manages its inventory.

Inventory Turnover ratio is calculated as follows:

Inventory Turnover Ratio = Cost of goods sold / Average Inventory

But why is the Cost of Goods Sold taken as a numerator instead of revenue while calculating the Inventory Turnover Ratio?

Inventory

See less

Depreciation refers to that portion of the value of an asset that a company uses in an accounting year to generate revenue. Assets are written off in form of depreciation over time also called the useful life of the asset. It denotes the wear and tear of an asset over time. Suppose, a company namedRead more

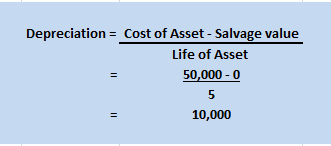

Depreciation refers to that portion of the value of an asset that a company uses in an accounting year to generate revenue. Assets are written off in form of depreciation over time also called the useful life of the asset. It denotes the wear and tear of an asset over time.

Suppose, a company named Johnson ltd. purchases machinery for 50,000 that has a useful life of 5 years with nil salvage value. Then the yearly depreciation to be charged can be calculated as:

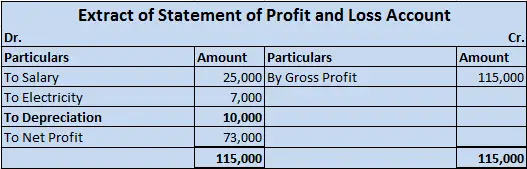

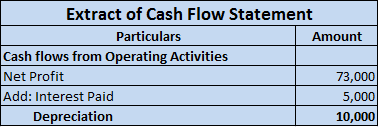

Cash flows are inflows and outflows of cash and cash equivalents in an entity. The payments made by the entity denote the outflows whereas the revenues or incomes of the entity denote the inflows. Talking about cash flows, depreciation is a non-cash item of expense which means it neither results in inflow nor outflow of cash resources.

In the adjacent Profit and Loss statement, a cash payment of 7,000 for electricity implies outflow of cash however, depreciation of 10,000 is merely an imputed cost to write off an asset or we can say, a part of profits set aside each year so that there are sufficient funds available to procure a new asset after the currently available asset is discarded.

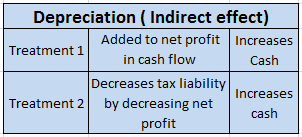

However, cash flow statements are affected by depreciation. Depreciation is added back to the net profits while calculating cash flows from operating expenses since it is a non-cash item and has been deducted while calculating net profits in the profit and loss statement.

Depreciation does not directly impact the amount of cash generated or expended by a business but it is tax-deductible and will reduce the cash outflows related to income taxes. Thus, depreciation affects cash flow by reducing the amount of cash a business has to pay for income taxes.

Definition The trial balance is a list of all the closing balances of the general ledger at the end of the year. Or in other words, I can say that it is a statement showing debit and credit balances. A trial balance is prepared on a particular date and not on a particular period. Importance As the tRead more

Definition

The trial balance is a list of all the closing balances of the general ledger at the end of the year. Or in other words, I can say that it is a statement showing debit and credit balances.

A trial balance is prepared on a particular date and not on a particular period.

Importance

As the trial balance is prepared at the end of the year so it is important for the preparation of financial statements like balance sheet or profit and loss

Purpose of trial balance which are as follows:

Preparation of trial balance

Methods of preparation

These are two methods that you can use to prepare trail balance, now let me explain to you in detail about these methods which are as follows:-

Balance method

Total amount method

Steps to prepare a trial balance

A suspense account is generated when the above case arises that is trial balance did not agree after transferring the balance of all ledger accounts including cash and bank balance.

And also errors are not located in timely, then the trial balance is tallied by transferring the difference between the debit and credit side to an account known as a suspense account.

Rules of trial balance

When we prepare a trial balance from the given list of ledger balances, the following rules to be kept in mind that are as follows :

Are placed in the debit column of the trial balance.

Are placed in the credit column of the trial balance.

See less