Meaning of Workmen's Compensation Reserve Workmen compensation reserve is a reserve created to compensate the labourers and employees of a firm in case of an uncertain future event in the line with their work. For example, if a labourer or group of labourers get injured seriously while working on thRead more

Meaning of Workmen’s Compensation Reserve

Workmen compensation reserve is a reserve created to compensate the labourers and employees of a firm in case of an uncertain future event in the line with their work. For example, if a labourer or group of labourers get injured seriously while working on the premises of the firm, then they will be compensated from the money kept aside in the workmen’s compensation reserve.

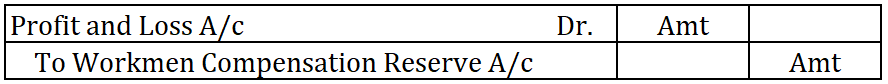

Workmen’s compensation reserve is created using the profits of a business. The journal entry for the creation of workmen compensation reserve is as follows:

When a claim arises, the claim amount is transferred to Provision for workmen compensation claim A/c

Treatment of workmen compensation reserve in revaluation account

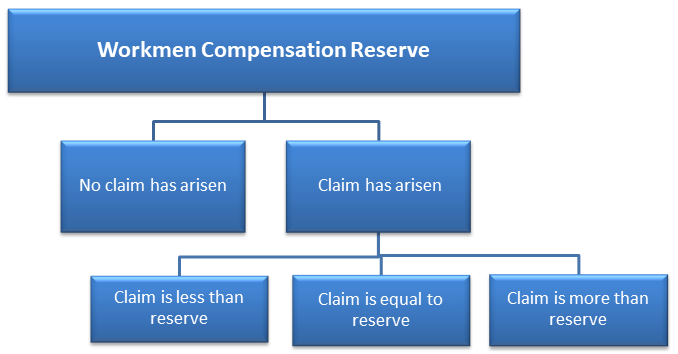

At the time of admission, retirement or death of partner or change in profit sharing ratio, the reserve is distributed among the old or existing partners or kept intact.

Workmen’s compensation reserve is also distributed among the old or existing partners subject to the claim arising on the reserve.

Here are the three situations:

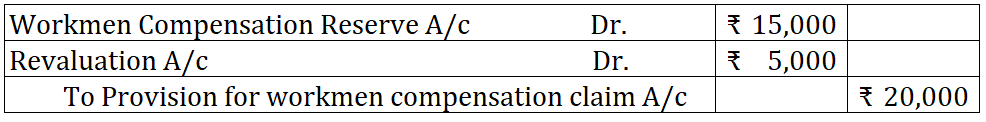

The revaluation account comes into the picture only when the claim is more than the amount available in the reserve. For example, the claim is Rs. 20,000 but the amount in the reserve is only Rs. 15,000.

In such a case, the excess claim will be met by debiting the revaluation account.

The journal will as given below:

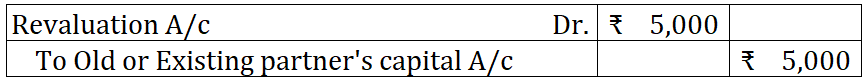

Since the revaluation account is debited, it is a loss and this loss will be written from old or existing partners’ capital in the old profit sharing ratio. The journal entry is given below:

Any person, company, or organization that owes us money is a debtor. The amount that is owed to us is called debt. When you are unsure if a debtor is going to pay back the amount owed to you, then a provision for doubtful debts is created. Here, the debtor may or may not pay back the amount owed. WhRead more

Any person, company, or organization that owes us money is a debtor. The amount that is owed to us is called debt. When you are unsure if a debtor is going to pay back the amount owed to you, then a provision for doubtful debts is created. Here, the debtor may or may not pay back the amount owed. When the debts owed to us is irrecoverable, it is termed as bad debts.

Provision for doubtful debts may become a bad debt at some point. Usually, companies keep a small portion of their debtors as a provision for doubtful debts in accordance with the prudence concept that tells us to account for all possible losses. Provision for doubtful debts is a liability whereas bad debts are recorded as an expense.

Journal entries for Doubtful debts and bad debts are as follows:

EXAMPLE

If the balance in the debtors’ account shows an amount of Rs 20,000 and 5% of debtors are treated as doubtful, then Rs 1,000 is recorded as a provision for doubtful debts. This amount is deducted from debtors in the balance sheet.

Now if Rs 400 was recorded as actual bad debts, then it is deducted from the provision for doubtful debts instead of debtors. Further another 400 is added back to provision for doubtful debts to maintain the percentage.

See less