Secondary books of accounts are most commonly known as subsidiary books of accounts or day books. They are prepared to record the same type of journals in an ordered manner in a special book. They are nothing, but special journals. Recording all the journals entries in a single journal and these posRead more

Secondary books of accounts are most commonly known as subsidiary books of accounts or day books. They are prepared to record the same type of journals in an ordered manner in a special book. They are nothing, but special journals.

Recording all the journals entries in a single journal and these posting them to different ledgers can be very difficult if the number of transactions is huge.

So, recording the same type of transactions in a special journal proves to be useful in efficient book-keeping and also information retrieval.

There are eight subsidiary books:

- Cashbook – It is three types. (a) Single column cash book – It records only cash receipts and cash payments. (b) Double column cash book – Apart from cash receipts and cash payments, it also records bank receipts and bank payments. (c) Triple column cash book – It additionally records the discount allowed and discount received.

- Purchase book – It records all the credit purchases except the purchase of assets.

- Sales book – It records all the credit sales except the sale of assets.

- Purchase return book – It records all the transactions related to the return of purchased goods.

- Sale return book – It records all the transactions related to the return of goods from customers.

- Bills receivable book – It records the particulars of all the bills drawn in favour of the business.

- Bills payable book – It records the particulars of all the bills drawn in the name of the business.

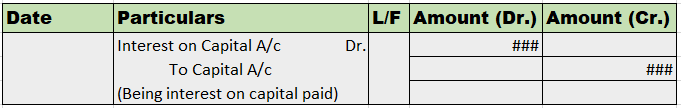

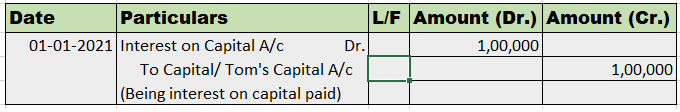

- Journal proper – It records those transactions which cannot be recorded in any of the above-mentioned books. For example, entry related to depreciation charged on assets.

Also, there are a few more things to know:-

- Subsidiary books may look like ledger accounts but they are not ledgers. Ledgers are books of final entry and subsidiary books can be said to be the book of intermediate entry and are not but special journals.

- Once transactions are recorded in the subsidiary books, they are then posted to the ledgers.

Unfavorable balance as per cash book generally means credit balance in the cash book. This is also known as bank overdraft. Making the above definition more clear, unfavorable balance or bank overdraft means an excessive amount of cash withdrawn than what is deposited in the bank. Simply it is the lRead more

Unfavorable balance as per cash book generally means credit balance in the cash book. This is also known as bank overdraft.

Making the above definition more clear, unfavorable balance or bank overdraft means an excessive amount of cash withdrawn than what is deposited in the bank. Simply it is the loan taken from the bank. When there is an overdraft balance the treatment is just the opposite of that of favorable balance.

Generally for business overdraft occurs when there is immediate or emergency funding for the short term. This can be seen for small and medium-sized businesses. This is considered to be convenient for these businesses because there is no requirement to pay interest on the lump-sum loan, only have to pay interest on the fund you use. Generally linked to an existing transaction account.

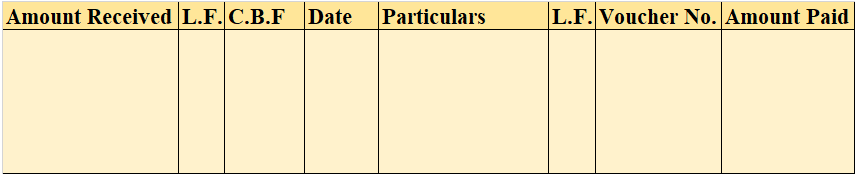

To reconcile this we need to prepare a Bank reconciliation statement. The procedure of preparing BRS under unfavorable conditions is as follows

Let us take one example considering one of the above conditions.

The cash book of M/s Alfa ltd shows a credit balance of Rs 6,500.

Bank Reconciliation Statement