To ascertain the debtors and creditors of the business To ascertain the financial position of the business To ascertain the profit or loss of the business To ascertain the collective effect of all ...

The word, “deferred” means delayed or postponed and “revenue” in layman’s terms means income. Therefore deferred revenue means the revenue which is yet to be recognised as income. It is actually unearned income. In accrual accounting, income is recognised only when it is accrued or earned. DeferredRead more

The word, “deferred” means delayed or postponed and “revenue” in layman’s terms means income. Therefore deferred revenue means the revenue which is yet to be recognised as income. It is actually unearned income.

In accrual accounting, income is recognised only when it is accrued or earned. Deferred revenue is the income received before the performance of the economic activity to earn it.

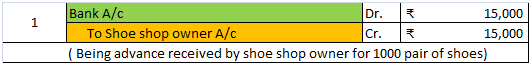

Example: A shoe shop owner gives an order to a shoe manufacturer of 1000 pair of shoes which is to be delivered after 4 months. He also gives him a cheque of ₹15,000 in advance, the rest ₹5000 is to be given at the time of delivery.

So, in this case, the ₹15,000 is actually is unearned revenue i.e. deferred revenue. It will be recognised as revenue when the shoe manufacture completes the order and deliver it.

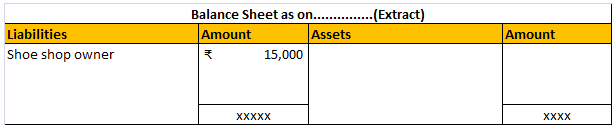

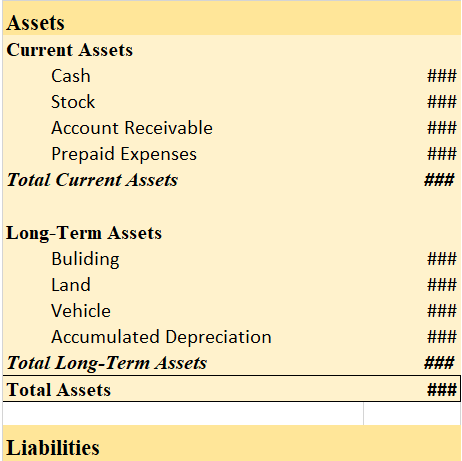

Till then, the deferred revenue is reported as a liability in the balance sheet. Like this:

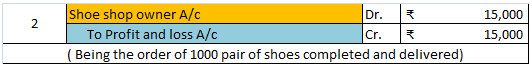

After recognition as revenue, it will be reported in the statement of profit or loss:

Hence, to summarise, deferred revenue is:

- Unearned revenue

- Recognised as income till it is earned

- Till then it is recognised and reported as a liability in the balance sheet.

Some examples of deferred revenue are as follows:

- Advance rent received

- Advance payment for goods to be delivered.

- Advanced payment for services to be provided.

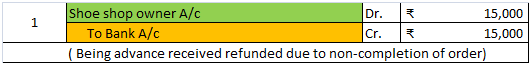

Now the question arises why deferred revenue is recognised as a liability. It is due to the fact that the business may not be able to perform the economic activity successfully to earn that revenue.

Taking the above example, suppose the shoe manufacturer is not able to honour its commitment and the shoe shop owner can wait no more, then the advanced money of ₹ 15,000 is to be refunded. That’s why deferred revenue is recognised as a liability because it is a liability if we consider the principle of conservatism (GAAP).

The correct answer is 4. To ascertain the collective effect of all transactions pertaining to a particular account. The reason being is that in the ledger account all the effects are recorded for example, how much money is spent on a particular type of expense or how much money is receivable from aRead more

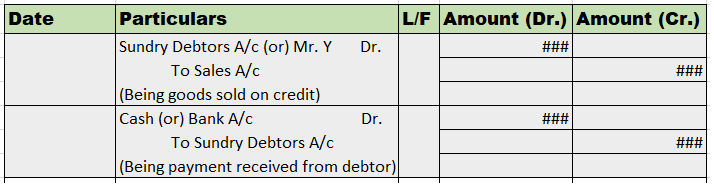

The correct answer is 4. To ascertain the collective effect of all transactions pertaining to a particular account. The reason being is that in the ledger account all the effects are recorded for example, how much money is spent on a particular type of expense or how much money is receivable from a debtor. In ledger accounts, information can be obtained about a particular account.

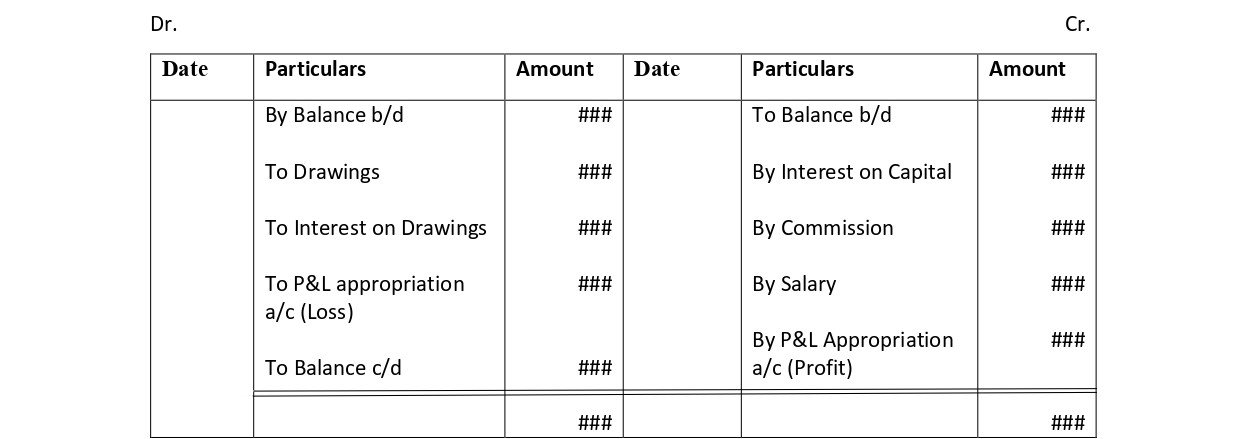

Ledger is the Principal book of accounts and also called the book of final entry. It summarises all types of accounts whether it is an Asset A/c, Liability A/c, Income A/c, or Expense A/c. The transactions recorded in the Journal/Subsidiary books are transferred to the respective ledger accounts opened.

Importance of preparing ledger accounts:

- Ledger accounts get the ready results i.e. helps in identifying the amount payable or receivable.

- It is necessary for the preparation of the Trial Balance.

- The financial position of the business is easily available with the help of Assets A/c and Liabilities A/c.

- It helps in preparing various types of income statements on the basis of balances shown in ledger accounts.

- It can be used as a control tool as it shows balances of various accounts.

- It is useful for the management to forecast or plan for the future.

See less