When a company issues shares to shareholders at a price over the face value (at a premium), that amount is termed as securities premium. This amount is transferred to what we call the securities premium reserve. The company is required to maintain a separate reserve for securities premium. UtilizatiRead more

When a company issues shares to shareholders at a price over the face value (at a premium), that amount is termed as securities premium. This amount is transferred to what we call the securities premium reserve. The company is required to maintain a separate reserve for securities premium.

Utilization

Securities premium reserve can be used for the following reasons:

- Issue of fully paid Bonus share capital.

- To cover preliminary expenses of a company.

- For funding the buy-back of securities.

Since it is not a free reserve, it can only be used for a few specific purposes. The amount received as securities premium cannot be used to transfer dividends to shareholders

Treatment

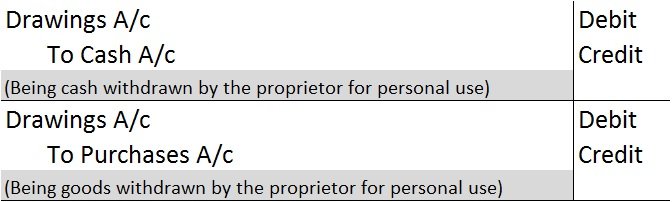

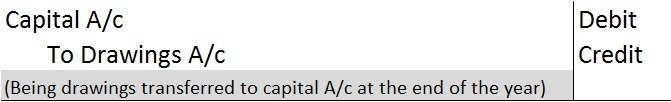

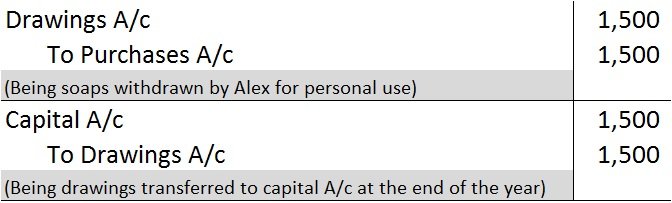

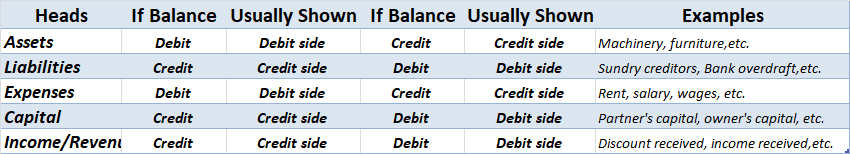

When a company issues shares at a premium, the securities premium reserve account is credited along with share capital as an increase in capital is credited according to the modern rule of accounting.

For example,

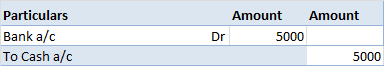

Sonly Ltd. issues 1,000 shares of $10 face value at $15. Here, the amount of premium would be $5 (15 – 10) per share. Therefore, the journal entry would show:

Bank a/c (15 x 1,000) Dr 15,000

To Share Capital (10 x 10,000) 10,000

To Securities Premium Reserve a/c (5 x 10,000) 5,000

From the above example, we can see that the company receives $15,000, but transfers $10,000 to share capital and the excess $5,000 to securities premium reserve.

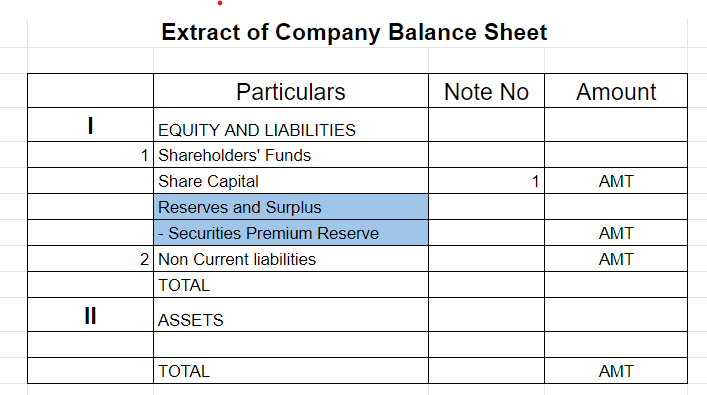

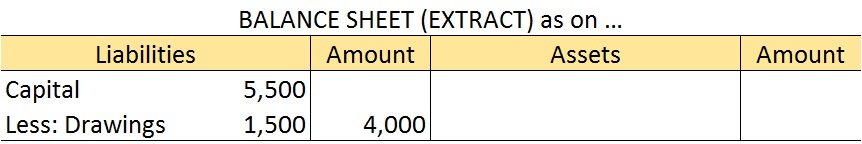

In the balance sheet, this securities premium reserve is shown under the title “Equity and Liabilities” under the head ‘‘Reserves and Surplus”.

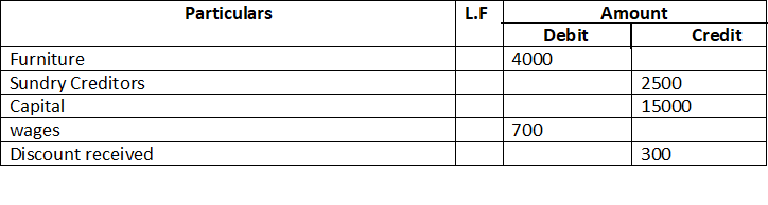

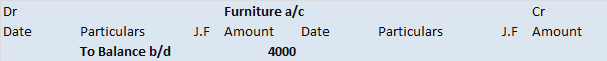

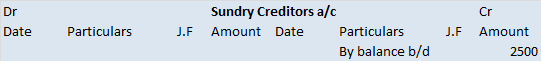

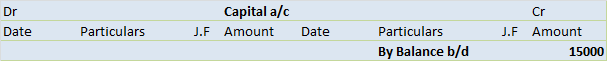

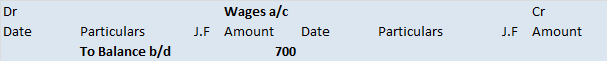

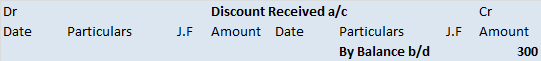

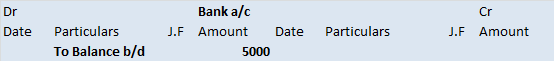

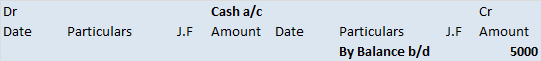

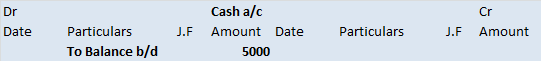

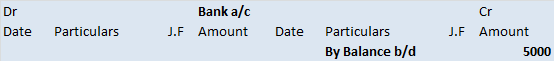

The trial balance shows the opening balance of various accounts. Now posting them in ledger accounts.

The trial balance shows the opening balance of various accounts. Now posting them in ledger accounts.

A Consignment Account is a Nominal Account. It is classified as a nominal A/c because it is prepared to ascertain the profit earned or loss incurred on the consignment. The accounting rule applied to consignment A/c: Debit all Expenses & Losses and Credit all Incomes & Gains. As per the modeRead more

A Consignment Account is a Nominal Account. It is classified as a nominal A/c because it is prepared to ascertain the profit earned or loss incurred on the consignment.

The accounting rule applied to consignment A/c: Debit all Expenses & Losses and Credit all Incomes & Gains.

As per the modern rules, there is no clear-cut classification of consignment A/c. It is prepared from the perspective of the consignor, hence it cannot be outrightly classified as an expense/revenue.

In the context of accounting, consignment refers to an arrangement of goods wherein the consignor sends the goods to the consignee so that the consignee can sell/distribute the goods on behalf of the consignor.

The relationship between the consignor and consignee is that of a principal and agent. The consignee gets a commission for his services.

You should keep in mind that the consignee does not get ownership of the goods even though the goods are in his possession. The ownership remains with the consignor till the sale is made. On sale, the buyer will become the owner.

A Consignment A/c is an account prepared to record the transactions happening in a consignment business. This account is maintained by the consignor. It shows the profit earned or loss incurred by the consignor on a specific consignment.

A consignor may send goods to more than one consignee. In such a case, a separate consignment A/c is prepared for each consignment.

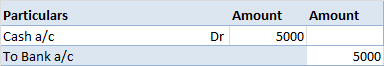

The following items appear on the debit side of the consignment A/c:

The entries appearing on the credit side of the consignment A/c are as follows:

The balance in the consignment A/c represents the profit or loss made on the consignment. It is transferred to the P&L A/c and the account is closed.

Below is the format for Consignment A/c:

See less