Activity-based costing (ABC) is a system used to find production costs. It breaks down overhead costs between production-related activities and other activities. The ABC system assigns costs to each activity that goes into production, such as workers testing a product. ABC is based on the principleRead more

Activity-based costing (ABC) is a system used to find production costs.

It breaks down overhead costs between production-related activities and other activities.

The ABC system assigns costs to each activity that goes into production, such as workers testing a product. ABC is based on the principle that ‘products consume activities.’

Traditional cost systems allocate costs based on direct labor, material costs, revenue, or other simplistic methods. As a result, traditional systems tend to over-cost high volume products, services, and customers; and under-cost low volume.

Hence, Activity Based Costing was developed for determining the cost. The basic feature of ABC is its focus on activities. It uses activities as the basis for determining the costs of products or services.

Activity-Based Costing is mostly used in manufacturing industries, however, its application is not only limited to that. Various industries like, construction, health care, medical organizations also use this method of assigning costs. Industries where customized products are made also tend to use such methods as it is easier to charge appropriate overhead costs from the customer.

Objectives of Activity-Based Costing:

Companies adopt ABC to assign cost elements to the products, activities, or services so that it helps the management to decide:

- which cost can be eliminated or cut back

- which products are unprofitable

- if a product is over-priced or under-priced

- if any activity is ineffective

- various processing of the same product to yield better results

Advantages of Activity Based Costing are:

- it takes into consideration both direct and overhead costs of creating a product.

- it recognizes the fact that different products require different indirect expenses.

- it sets prices more accurately.

- it helps to see what overhead cost the company might be able to cut back on.

- it helps to segregate fixed costs, variable cost, and overhead cost which helps to identify “cost drivers”.

- it focuses on cost allocation in operational management.

Before implementing ABC, a company should consider the following:

- manually driven Activity Based Accounting cost derivers is an inefficient use of resources.

- it is an expensive method and it is difficult to implement

- for small gains, there are alternative costing methods available for a company to use.

Formula= Total Cost Pool / Cost Driver

For example:

For a company, the salary for workers is Rs 1,00,000 for a financial year, the number of labor hours worked is 50,00 hrs. The cost driver rate is calculated by dividing the workers’ salary by the labor hours worked, that is,

Salary of the workers / Number of labor hours

Rs 1,00,000 / 50,000 hrs = Rs 2 per labor hour.

In the above example, the salary of the workers is the total cost pool or the overhead cost for which we want to find the cost driver rate and labor hours is the cost driver, that is, on the basis of what we want to find the rate.

See less

Let the business in our example be X Trading. The 15 transactions are as follows: 1st April - X Trading started its business with Rs. 10,000 cash and furniture of Rs. 5,000. 5th April - Purchased 1,000 units of goods for Rs. 1,000 in cash from Ram. 10th April – Bought stationery for Rs. 100 in cash.Read more

Let the business in our example be X Trading. The 15 transactions are as follows:

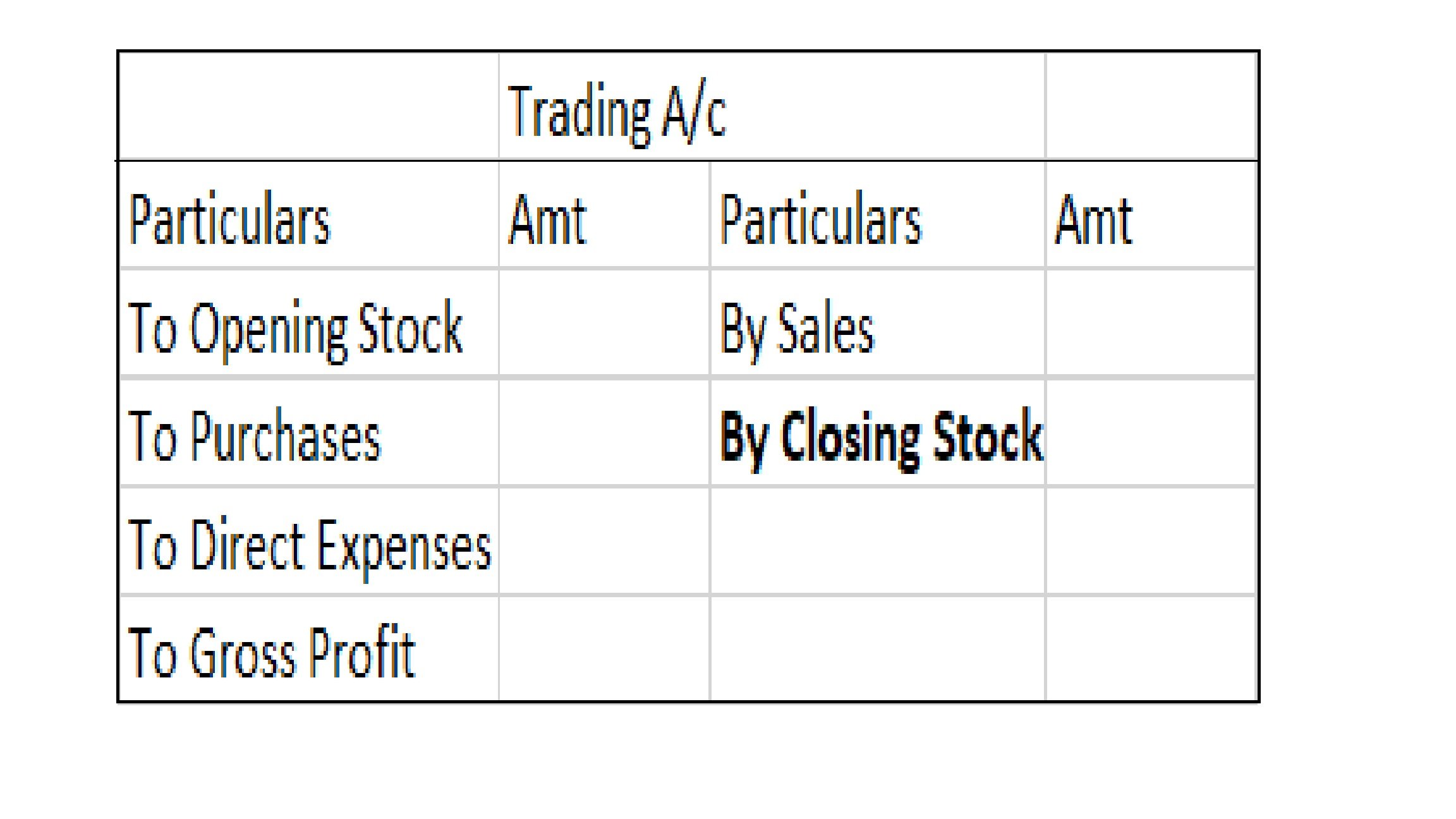

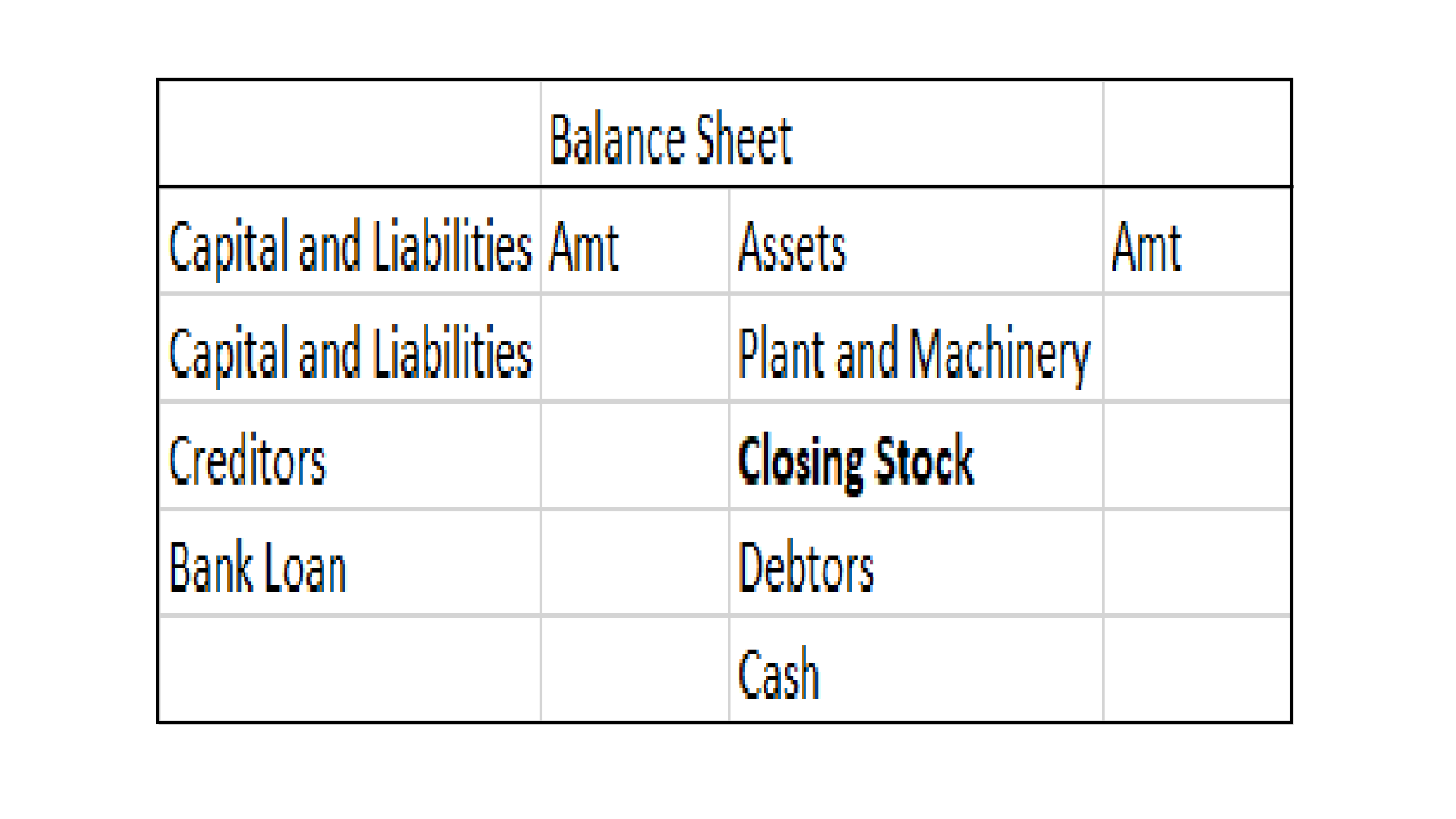

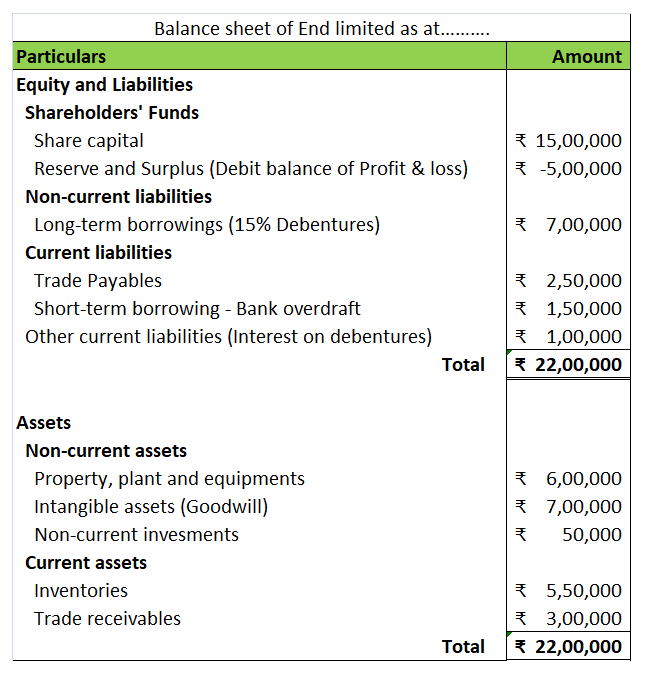

We will prepare the journal, ledgers and the trial balance from the above transactions.

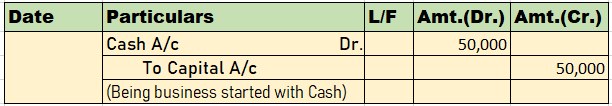

Journal

Journal is known as the book of primary entry or book of original entry. It is because every transaction is recorded in form of journal entries in the journal. Every journal entry affects at least two accounts (dual effect). A transaction has to be a monetary transaction otherwise it cannot be recorded as a journal entry.

The procedure of recording transactions as journal entries is simple if we follow the modern rules of accounting.

So first we have to identify which and what type of account does a transaction affect. The types of accounts are:

Ledger

Ledgers are known as the books of principal entry or book of final entry. All the journal entries recorded in the journal are posted to the ledgers. A Ledger is where the entries related to a particular account are recorded. For example, all the transactions related to salary will be recorded in the salary account ledger.

It is very important to prepare the ledger to arrive at the balance of each account in the books of concern so that it can prepare its trial balance.

The procedure of posting journal entries in the ledger account is done is as follows:

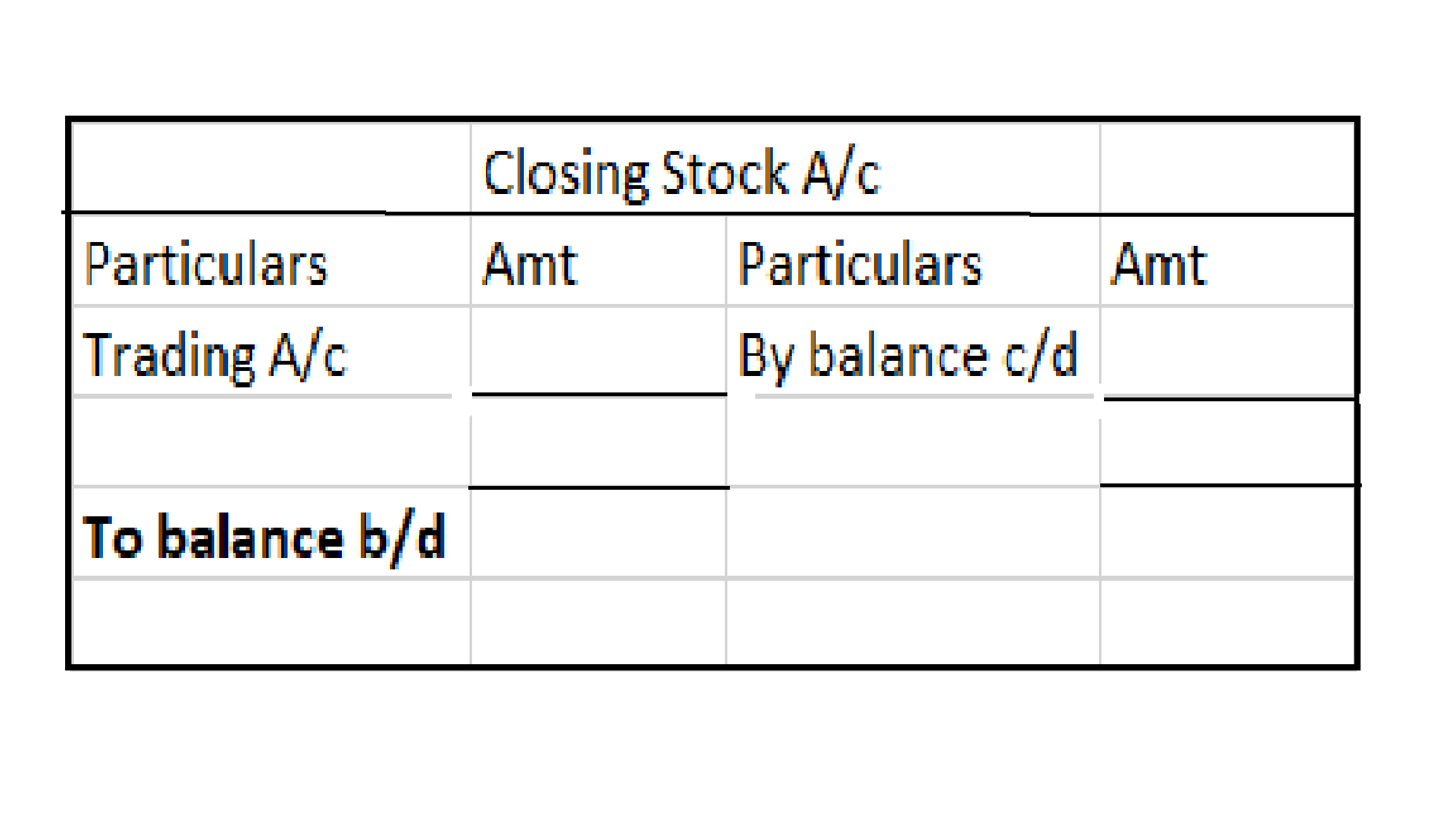

The ledgers are as follows:

Trial Balance

The trial balance is not a part of the books of accounts. It is just a statement prepared to check the arithmetical accuracy of the books of the accounts. It also helps to know about the omission and posting mistakes. It is prepared after the ledger accounts have been drawn and their balances have been ascertained.

The balance of all the ledger accounts is posted on either side of the trial balance. Debit balance of the account on the debit side and credit balance of the account on the credit side.

Also, the closing stock from the financial statements of the previous year is posted on the debit side of the trial balance as opening stock to account for the stock with the business at the beginning of the financial year.

Following is the trial balance of X trading:

See less