No, they are not the same. They are both used to measure the short term liquidity of a business but their approach is different. Following are the differences between the two : Let’s take an example. Following is the balance sheet of X Ltd: Hence, as per the following information, Current Ratio = CuRead more

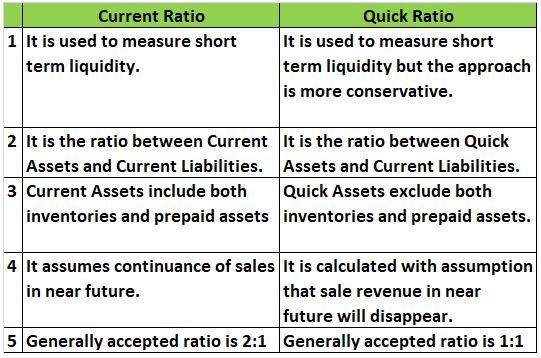

No, they are not the same. They are both used to measure the short term liquidity of a business but their approach is different. Following are the differences between the two :

Let’s take an example.

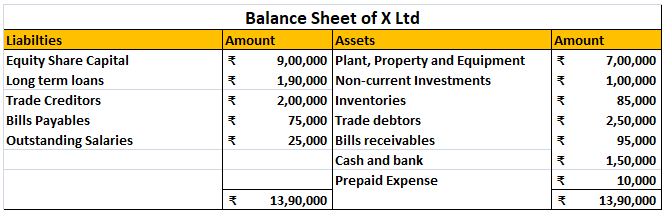

Following is the balance sheet of X Ltd:

Hence, as per the following information,

Current Ratio = Current Assets / Current Liabilities

= Inventories + Trade debtors + Bills receivables + Cash and bank + Prepaid Expenses / Trade Creditors + Bills Payables + Outstanding Salaries

= ₹85,000 + ₹2,50,000+ ₹95,000 + ₹1,50,000 + ₹10,000/ ₹2,00,000 + ₹75,000 + ₹25,000

= ₹6,00,000 / ₹3,00,000

= 2/1 or 2:1

Quick Ratio = Quick Assets / Current Liabilities

= Trade debtors + Bills receivables + Cash and bank / Trade Creditors + Bills Payables + Outstanding Salaries

= ₹2,50,000+ ₹95,000 + ₹1,50,000 / ₹2,00,000 + ₹75,000 + ₹25,000

= ₹5,05,000/ ₹3,00,000

= 41 / 25 or 1.68 : 1

Let’s discuss both ratios in detail.

1. Current ratio:

The current ratio represents the relationship between current assets and current liabilities

Current ratio = Current Assets/Current Liabilities

It measures the adequacy of the current assets to current liabilities. The main question this ratio tries to answer is: – “Does your business have enough current assets to meet the payment schedule of its current debts with a margin of safety for possible losses in current assets?”

The generally acceptable current ratio is 2:1. But it depends on the characteristics of the assets of a business to judge whether a specific ratio is satisfactory or not.

2. Quick Ratio: Quick ratio is the ratio between quick assets and current liabilities. It is also known as the Acid Test Ratio. By quick assets, we mean cash or the assets that can be quickly converted into cash ( near cash assets)

Quick Assets = Current Assets – Inventories – Prepaid assets

Quick ratio = Quick Assets/Current Liabilities

Inventories are not considered near cash assets.

The quick ratio is a more conservative approach than the current ratio to measure the short term liquidity of a firm.

It answers the question, “If sales revenues disappear, could my business meet its current obligations with the readily convertible quick funds on hands?”

1:1 is considered satisfactory unless the majority of the quick asset are accounts receivable and the receivables turnover ratio is low.

See less

Meaning of Workmen's Compensation Reserve Workmen compensation reserve is a reserve created to compensate the labourers and employees of a firm in case of an uncertain future event in the line with their work. For example, if a labourer or group of labourers get injured seriously while working on thRead more

Meaning of Workmen’s Compensation Reserve

Workmen compensation reserve is a reserve created to compensate the labourers and employees of a firm in case of an uncertain future event in the line with their work. For example, if a labourer or group of labourers get injured seriously while working on the premises of the firm, then they will be compensated from the money kept aside in the workmen’s compensation reserve.

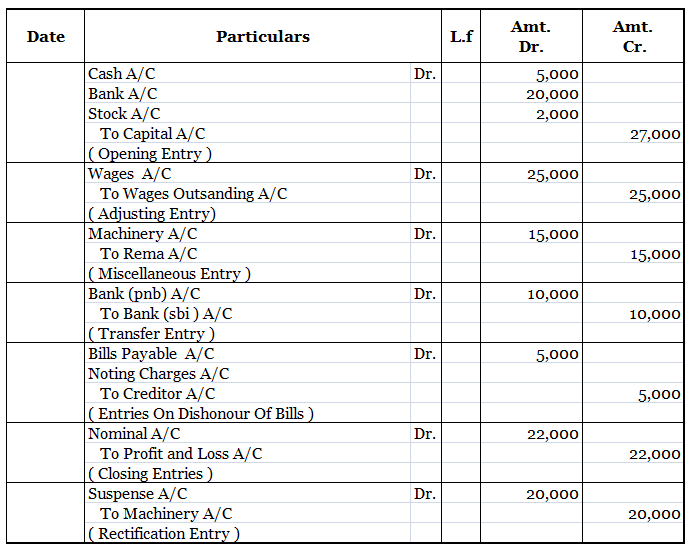

Workmen’s compensation reserve is created using the profits of a business. The journal entry for the creation of workmen compensation reserve is as follows:

When a claim arises, the claim amount is transferred to Provision for workmen compensation claim A/c

Treatment of workmen compensation reserve in revaluation account

At the time of admission, retirement or death of partner or change in profit sharing ratio, the reserve is distributed among the old or existing partners or kept intact.

Workmen’s compensation reserve is also distributed among the old or existing partners subject to the claim arising on the reserve.

Here are the three situations:

The revaluation account comes into the picture only when the claim is more than the amount available in the reserve. For example, the claim is Rs. 20,000 but the amount in the reserve is only Rs. 15,000.

In such a case, the excess claim will be met by debiting the revaluation account.

The journal will as given below:

Since the revaluation account is debited, it is a loss and this loss will be written from old or existing partners’ capital in the old profit sharing ratio. The journal entry is given below:

See less