As per Wiki, it is also called construction in progress. Capital work in progress is a non-current asset of an entity. It is also known as CWIP in short. CWIP is the work which is not yet completed but the amount for which has already been paid. Suppose, at the time of preparing a balance sheet, ifRead more

As per Wiki, it is also called construction in progress. Capital work in progress is a non-current asset of an entity. It is also known as CWIP in short.

CWIP is the work which is not yet completed but the amount for which has already been paid.

Suppose, at the time of preparing a balance sheet, if an asset is not completed, all the costs incurred on that asset up to the balance sheet date are to be transferred to an account called capital work in progress.

Example 1: A machinery under installation.

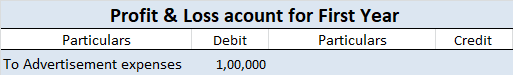

There are several expenses incurred while installing machinery, expenses such as labor charges, Initial delivery and handling costs, Assembly and installation cost, etc are included in CWIP and when the asset is completed and is ready to use, all the costs are transferred to the relevant accounts.

To make it simpler, let me show journal entries relating to this example.

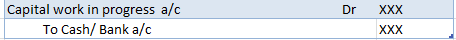

When an expense is incurred/paid:

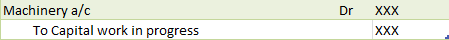

When an asset is complete and put to use:

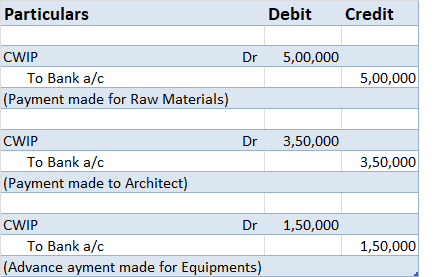

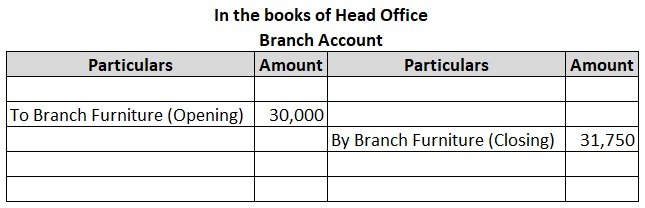

Example 2: A Contractor is constructing a building. The following expenditures are being incurred to date:

i) Raw materials – 5,00,000

ii) Payment to Architect – 3,50,000

iii) Advance for Equipments – 1,50,000

Following accounting entries will be passed to record the expenditure on CWIP assets:

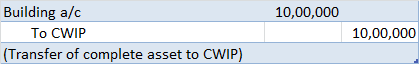

The following accounting entry will be passed once assets are ready to use:

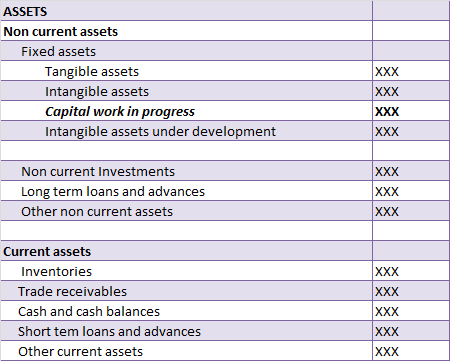

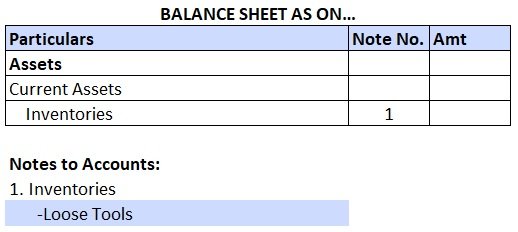

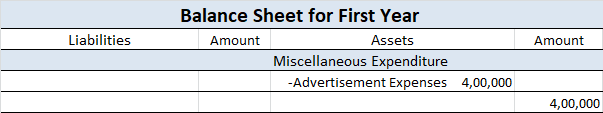

Disclosure in the Balance sheet

CWIP account is shown separately in the balance sheet below the fixed asset.

we cannot depreciate capital work in progress. It can only be depreciated when the asset is put to use.

Secondary books of accounts are most commonly known as subsidiary books of accounts or day books. They are prepared to record the same type of journals in an ordered manner in a special book. They are nothing, but special journals. Recording all the journals entries in a single journal and these posRead more

Secondary books of accounts are most commonly known as subsidiary books of accounts or day books. They are prepared to record the same type of journals in an ordered manner in a special book. They are nothing, but special journals.

Recording all the journals entries in a single journal and these posting them to different ledgers can be very difficult if the number of transactions is huge.

So, recording the same type of transactions in a special journal proves to be useful in efficient book-keeping and also information retrieval.

There are eight subsidiary books:

Also, there are a few more things to know:-

- Subsidiary books may look like ledger accounts but they are not ledgers. Ledgers are books of final entry and subsidiary books can be said to be the book of intermediate entry and are not but special journals.

- Once transactions are recorded in the subsidiary books, they are then posted to the ledgers.

See less